G

TUITION ASSISTANCE PROGRAM

TUITION REIMBURSEMENT PROGRAM

Contents

Tuition Assistance Program.......................................................................................................................... 1

Tuition Reimbursement Program ................................................................................................................. 1

Eligibility .................................................................................................................................................. 2-3

Wait Periods ................................................................................................................................................ 4

Breaks in Service ......................................................................................................................................... 4

Temporary Service ....................................................................................................................................... 4

Course Eligibility .......................................................................................................................................... 5

Certificate and Licensing Programs .............................................................................................................. 6

Credit/Course Limits ................................................................................................................................. 7-8

Prior Service ................................................................................................................................................ 9

Enrollment Periods and Counting Your Credit Limit ...................................................................................... 9

Doctoral Fees .............................................................................................................................................. 9

Imputed Income and Tax Withholding for Graduate-Credit Courses ........................................................... 10

FAQs ......................................................................................................................................................... 11

Harvard Schools Participating in TAP and Registration Process ...............................................................12-18

Non-Harvard Course Registration and Reimbursement ..........................................................................19-20

HUCTW Education Assistance Fund ............................................................................................................ 20

Tuition Program Contact Information ........................................................................................................ 20

1

Tuition Assistance Program

Harvard’s Tuition Assistance Program (TAP) helps pay the cost of tuition for courses taken at participating

Harvard Schools.

You can use TAP to explore an academic field or pursue an academic degree.

TAP is available to eligible Harvard employees including professional & administrative, support, hourly, and

faculty. Please refer to pages 2 & 3 for eligibility requirements.

Before enrolling in a course, it is important to familiarize yourself with the TAP guidelines outlined in this

guide.

Tuition Reimbursement Program

Harvard’s Tuition Reimbursement Program (TRP) helps pay the cost of tuition for qualifying courses taken at

other accredited* institutions. Reimbursement is for tuition only. You cannot be reimbursed for any fees

associated with the course.

TRP is available to eligible Harvard employees including professional & administrative, support, hourly, and

faculty. Please refer to page 2 and 3 for eligibility requirements.

Before enrolling in a course, it is important to familiarize yourself with the TRP guidelines outlined in this

guide.

Questions?

If after reviewing this booklet you have additional questions, contact Benefits at (617) 496-4001 or

Although all possible care has been taken in the preparation of this text, any errors or inconsistencies are not binding.

Interpretation of the rules and policies of TAP and TRP are subject to the discretion of the Plan Administrator. The Tuition

Assistance Program and Tuition Reimbursement Program are subject to change without notice.

*Refer to the U.S. Department of Education website for a listing of accredited institutions - http://ope.ed.gov/accreditation/search.aspx

2

Eligibility

In order to be eligible for TAP and TRP, you must be an active Harvard employee in a paid benefits-eligible

position on Harvard’s regular payroll, in an eligible employee classification, and you must have the minimum

required hours (see chart on next page) listed in PeopleSoft. If you are in a union, eligibility is also based on your

collective bargaining agreement.

Extended Part-time Employees (EPEs) are eligible for TAP if they are active Harvard employees who have

worked a minimum of 360 hours in a 9-month period in the previous fiscal year (July 1 through June 30). The

Office of Labor and Employee Relations will notify you annually if you are eligible for EPE benefits. EPEs are NOT

eligible for TRP.

Full-Time Student Status Employees covered under HUCTW can use TAP and TRP while enrolled as a full-time

student in a degree program. Please note, some Harvard schools do not confer degrees to students using TAP nor

allow full-time students to use TAP. For more information go to “Harvard Schools Participating in TAP” on page

12. Employees who are not covered under HUCTW cannot use TAP or TRP while enrolled as a full-time student

except at Harvard Extension School.

Paid Leave of Absence Employees on a paid leave of absence are eligible provided they meet the eligibility

requirements outlined above, and in the chart on the next page.

Retirees are defined as those who are at least age 55 with 10 years of participation service at the time of

separation from the University and are only eligible for TAP.

Ineligible Groups

Employees who fall into the following employee statuses or classifications are not eligible

to participate in TAP or TRP.

• Teaching Assistant/Other Staff

• External Post Doc Non-Harvard Research

• Temporary staff (Except Eligible EPEs)

• Off Campus Work Study

• Temporary Academic

• Special Exclusion

• Employees on Short Term Disability

• Employees on Long Term Disability

• Employees on MA PFML other than Bonding Leave (Employees on bonding leave need to contact the

Benefits Office prior to registering for TAP courses; and immediately after submitting reimbursement

for TRP)

• Employees on Workers Compensation

• Temporary Student

• Intern

• Harvard Graduate Student Fellowship (Includes Full-time)

• Spouses and Dependents of Employees

• Employees who are on an unpaid leave of absence or unpaid sabbatical at any time during a non-

Harvard course

• Employees who are on an unpaid leave of absence or unpaid sabbatical as of the first day of a

Harvard course

• Employees who terminate or become ineligible at any time during a non-Harvard course

• Employees who are terminated or ineligible as of the first day of a Harvard course

3

Eligibility

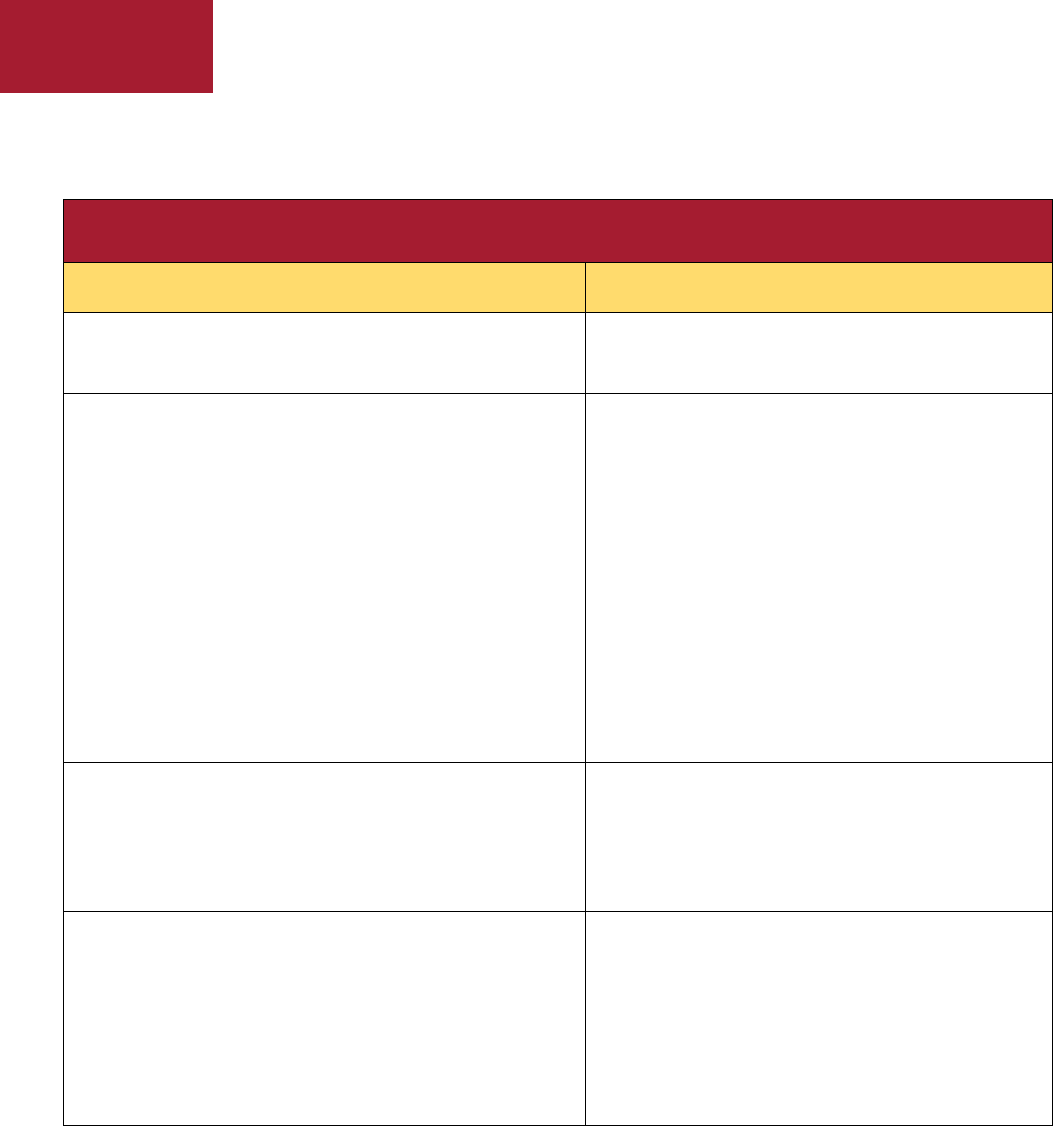

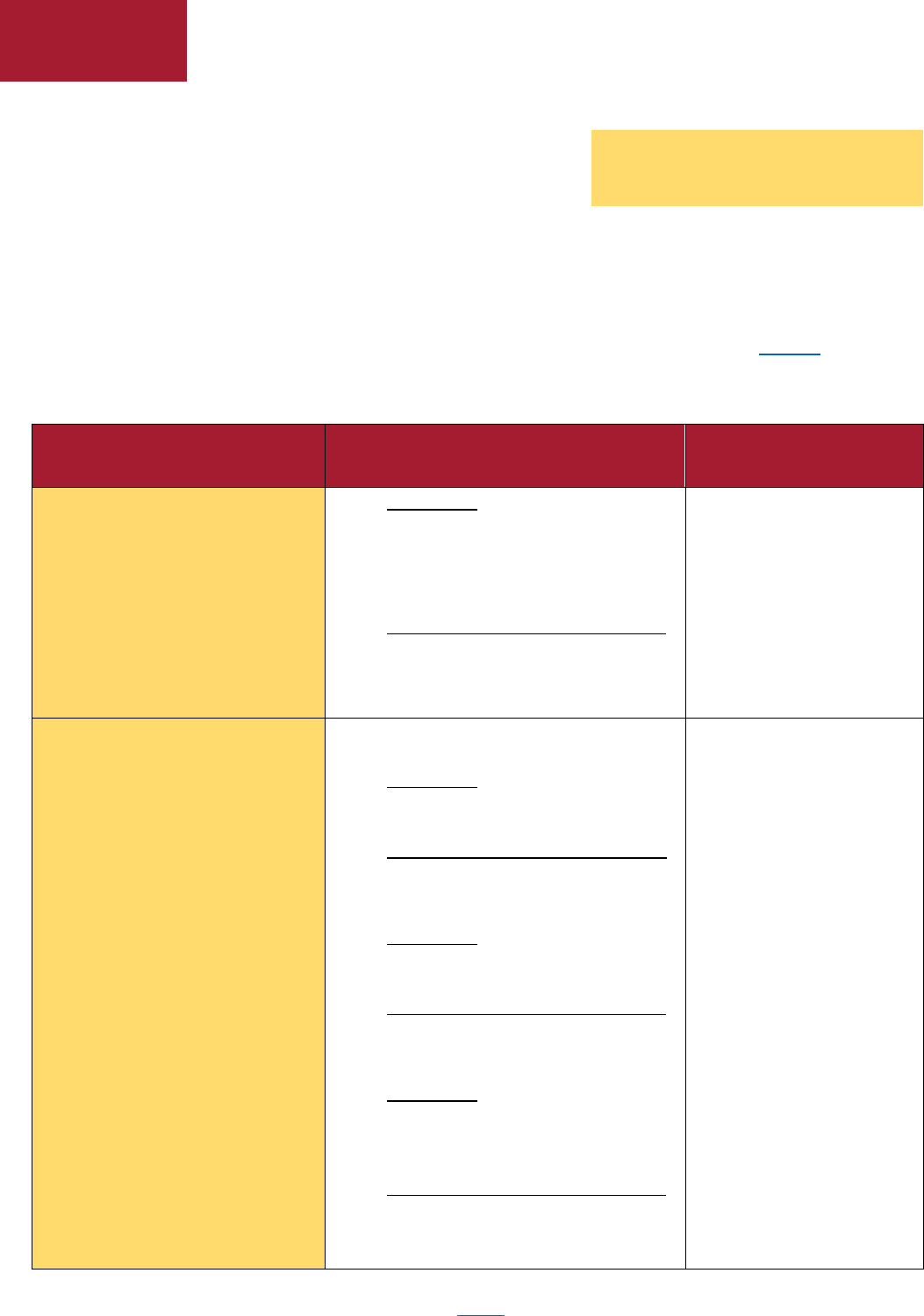

Classifications are for the purpose of the Tuition Program

Employee Classification

Minimum Required Hours Per Week

Part-time Service & Trades (Limited Regulars)

16

Faculty (including Junior Faculty and Other Faculty)

Administrative & Professional

Non-bargaining Unit Non-exempt

Non-union Support Staff

HUCTW Support Staff

Internal Post Doc doing Harvard Research

External Post Doc doing Harvard Research

Harvard University Police (HUPA)

17.5

Service & Trade Hourly

Dining Services employees are eligible during months of

regularly scheduled non-employment

20

Custodial Services, Electricians & Carpenters (ATC), and

Arnold Arboretum

More than 20

4

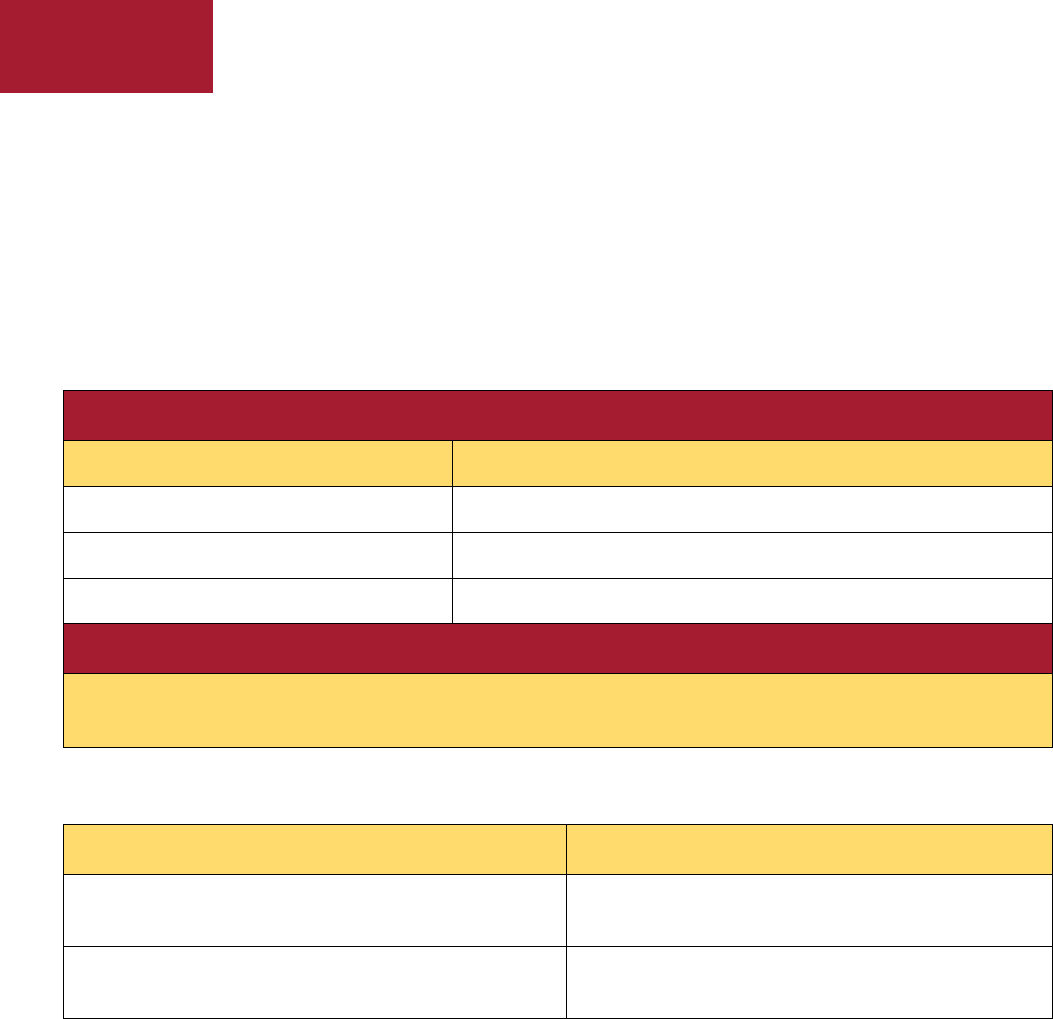

Wait Periods

You must fulfill a wait period in an eligible employee position before you can participate in TAP and TRP.

HUCTW Staff

The wait period for TAP and TRP is the 90-day Orientation and Review Period (O&R). After the completion of the

O&R, you can use the TAP benefit to enroll in Harvard courses and the TRP benefit to enroll in eligible non-

Harvard courses. The first day of class must be on or after your 90th day of benefits-eligible employment.

Faculty and Non-HUCTW Employees

TAP

Date of Hire

Eligible For

On or before July 1st

Fall semester

On or before November 1st

Spring semester (includes January session)

On or before April 1st

Summer Semester

TRP

There is a 180-day wait period. The first day of class must be on or after your 180th day of employment in a

benefits-eligible position.

Breaks in Service

Length of Break

Wait Period

Up to 30 days

Do not need to fulfill wait period if previously

fulfilled in a TAP/TRP-eligible position

More than 30 days

Must fulfill wait period

Temporary Service

A temporary employee working for Harvard with the requisite hours who is hired into a benefits-eligible position

without a break in service can use this temp time toward fulfilling the wait period. The employee must complete

the 90-day Orientation & Review period before they can be credited with the service.

Exception

For Certificate or professional programs offered through a Harvard school that participates in TAP and held

outside the regular academic schedule, your date of hire must be at least 90 days before the program begins. The

first day of class can be on the 90th day of employment.

5

Course Eligibility

TAP

Eligible Courses

• Courses at participating Harvard schools (See Harvard Schools Participating in TAP starting on page

12), including audited courses taken for no grade or no credit, and courses taken pass/fail for credit

• Harvard conferences, seminars, executive education, and certificate programs only if the program

offering the course within the specific school participates in TAP. Contact the program to confirm

their participation in TAP

• Online distance education courses, subject to the above provisions

Ineligible Courses

• Courses taken while in a degree program that requires full-time attendance unless you are a full-

time student at the Harvard Extension School, or an employee covered under HUCTW

Note: Some Harvard schools do not confer degrees to TAP students. Refer to Harvard Schools

Participating in TAP on page 12 for more information.

TRP

Eligible Courses

• Graduate courses that are job-related*

taken at an accredited institution

†

for credit and a letter

grade

‡

• Undergraduate courses that apply toward a degree taken at an accredited institution

†

for credit

and a letter grade

‡

• Online distance education courses, subject to the above provisions

Ineligible Courses

• Audited courses taken for no credit and no letter grade

• Conferences, seminars, executive education, and certificate programs

§

• Graduate courses that are not job-related,*

unless you are covered by HUCTW

• Continuing education courses

• Undergraduate courses taken while not enrolled in a degree program

• Any course taken while in a degree program that requires full-time attendance (does not apply to

employees covered under HUCTW).

* A course is considered to be job-related if it maintains or improves the skills required for an individual’s employment in their

current job at Harvard. See page 10 for more details.

† Refer to the US Department of Education website - http://ope.ed.gov/accreditation/search.aspx

‡ Courses that are available only as pass/fail may be eligible provided they are taken for credit and meet all other eligibility criteria.

You must provide a letter from your school stating the course is available only as pass/fail and was taken for credit.

§ Except graduate certificate in research administration at Emmanuel College. Employees covered under HUCTW and services &

trades unions are eligible to use TRP for certificate programs (see next page for details).

6

Certificate and Licensing Programs

Employees covered under HUCTW and services & trade unions are eligible to use TAP and TRP for certificate and

licensing programs. If a certificate program is taken at a Harvard school that doesn’t participate in TAP, the

program can be reimbursed according to the TRP reimbursement policy (see page 19 for details) provided it

meets program eligibility criteria.

Program Eligibility

In order to be eligible, the certificate or licensing obtained must meet the following criteria:

• Must provide education that supports the core duty of an internal Harvard University position

• Must be provided by an accredited educational institution* or an educational institution otherwise

recognized by the license-granting body for that particular trade

Certificate and Licensing Program Reimbursement Schedule

Certificate and licensing programs consisting of one course that take more than one semester to complete will be

reimbursed upon completion and presentation of the certificate. The reimbursement request must be submitted

within 60 days of the successful completion of the program. Please refer to pages 19 & 20 for more details on the

reimbursement process, including a listing of required documentation.

Certificate and licensing programs consisting of more than one course will be reimbursed upon the successful

completion of each course that is part of the program. The reimbursement request must be submitted within 60

days of the successful completion of each course. Please refer to pages 19 & 20 for more details on the

reimbursement process, including a listing of required documentation.

*Refer to the U.S. Department of Education website for a listing of accredited institutions - http://ope.ed.gov/accreditation/search.aspx

7

Credit/Course Limits

The number of credits/courses you can take in any given is based on

your years of benefits-eligible service, your employee classification,

and whether the course is a Harvard (TAP) or non-Harvard course

(TRP). Please note, Harvard Extension and Summer Schools (DCE)

and Office of the Arts (OFA) limits are based on the number of

courses, not credits.

Harvard and Non-Harvard Courses Taken in the Same Semester

You can take both Harvard and non-Harvard courses in the same

semester provided you are eligible for both and have the available

credits.

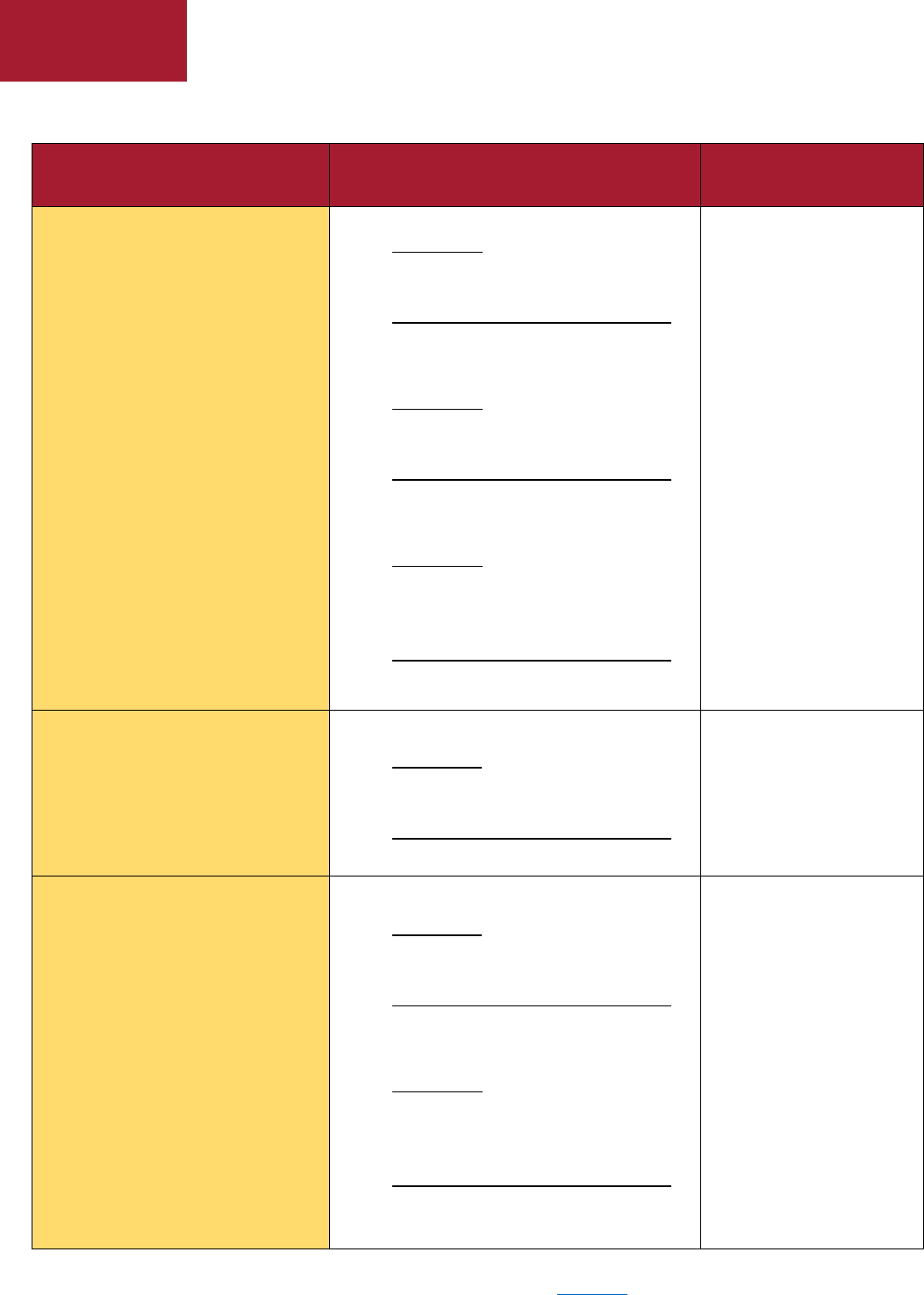

Employee Classification

TAP Credit/Course Limits

TRP Credit Limits

HUCTW Bargaining Unit

• DCE or OFA

Two (2) courses per semester*

If more than 15 years of service, one

(1) course per semester is free

Or

• Other Harvard participating schools

Ten (10) credits per semester*

If more than 15 years of service, five

(5) credits per semester are free

90% reimbursement up to

$5,250 per calendar year

for eligible courses

Administrative, Teaching, and

Research

Administrative & Professional

Faculty

Non-Bargaining Union Non-

Exempt Staff

Internal Post Doc

External Post Doc, Harvard

Research

• Less than 1 year of service

▪ DCE or OFA

One (1) course per semester*

Or

▪ Other Harvard participating schools

Five (5) credits per semester*

• 1-15 years of service

†

▪ DCE or OFA

Two (2) courses per semester*

Or

▪ Other Harvard participating schools

Ten (10) credits per semester*

• More than 15 years of service

†

▪ DCE or OFA

Same as 1-15 years of service, one

(1) course per semester is free

Or

▪ Other Harvard participating schools

Same as 1-15 years of service, five

(5) credits per semester are free

Ten (10) credits per

semester* reimbursed at

75% up to $5,250 per

calendar year

* The Tuition Program is based on the calendar year (January to December). You are entitled to reimbursement/assistance for up to

three (3) distinct enrollment periods per calendar year. See page 9 for more information.

† If your service anniversary at 1 or 15 years falls within the add/drop period for a semester, you are eligible for the higher credit limit

and benefit as of that semester.

Tax Withholding and Imputed

Income

Per IRS regulations, tuition benefits in

excess of $5,250 for graduate-credit

courses that do not meet the IRS

standard of job-relatedness are

considered taxable income to the

employee. Refer to page 10 for details.

8

Credit/Course Limits

Employee Classification

TAP Credit/Course Limits

TRP Credit Limits

Services & Trades Hourly

SEIU

Dining Services

HU Police

ATC

• Less than 1 year of service

▪ DCE or OFA

One (1) course per semester*

Or

▪ Other Harvard participating schools

Four (4) credits per semester*

• 1-15 years of service

†

▪ DCE or OFA

Two (2) courses per semester*

Or

▪ Other Harvard participating schools

Eight (8) credits per semester*

• More than 15 years of service

†

▪ DCE or OFA

Same as 1-15 years of service, one (1)

course per semester is free

Or

▪ Other Harvard participating schools

Same as 1-15 years of service, four (4)

credits per semester are free

Eight (8) credits per

semester* reimbursed at

75% up to $5,250 per

calendar year

Part-Time Services & Trades

Limited Regulars

Extended Part-Time Employees

(EPE)

• Once wait period is met

▪ DCE or OFA

One (1) courses per semester*

Or

▪ Other Harvard participating schools

Four (4) credits per semester*

Not Eligible

Retirees

Those who at the time of

retirement or separation from the

University were at least age 55 with

a minimum of 10 years of

participation service

• 10-15 Years of Service

▪ DCE or OFA

Two (2) courses per semester*

Or

▪ Other Harvard participating schools

Eight (8) credits per semester*

• More than 15 years of service

†

▪ DCE or OFA

Same as 10-15 years of service, one

(1) course per semester is free

Or

▪ Other Harvard participating schools

Same as 10-15 years of service, four

(4) credits per semester are free

Not Eligible

* The Tuition Program is based on the calendar year (January to December). You are entitled to reimbursement/assistance for

up to three (3) distinct enrollment periods per calendar year. Please see next page for more information.

† If your service anniversary at 1 or 15 years falls within the add/drop period for a semester, you are eligible for the higher

credit limit and benefit as of that semester.

9

Prior Service

Benefits eligible service from prior employment at the University will count towards determining your

credit/course limit. For the purposes of the Tuition Program, you receive benefits eligible service for each month

you are an active paid employee in a TAP/TRP-eligible job classification.

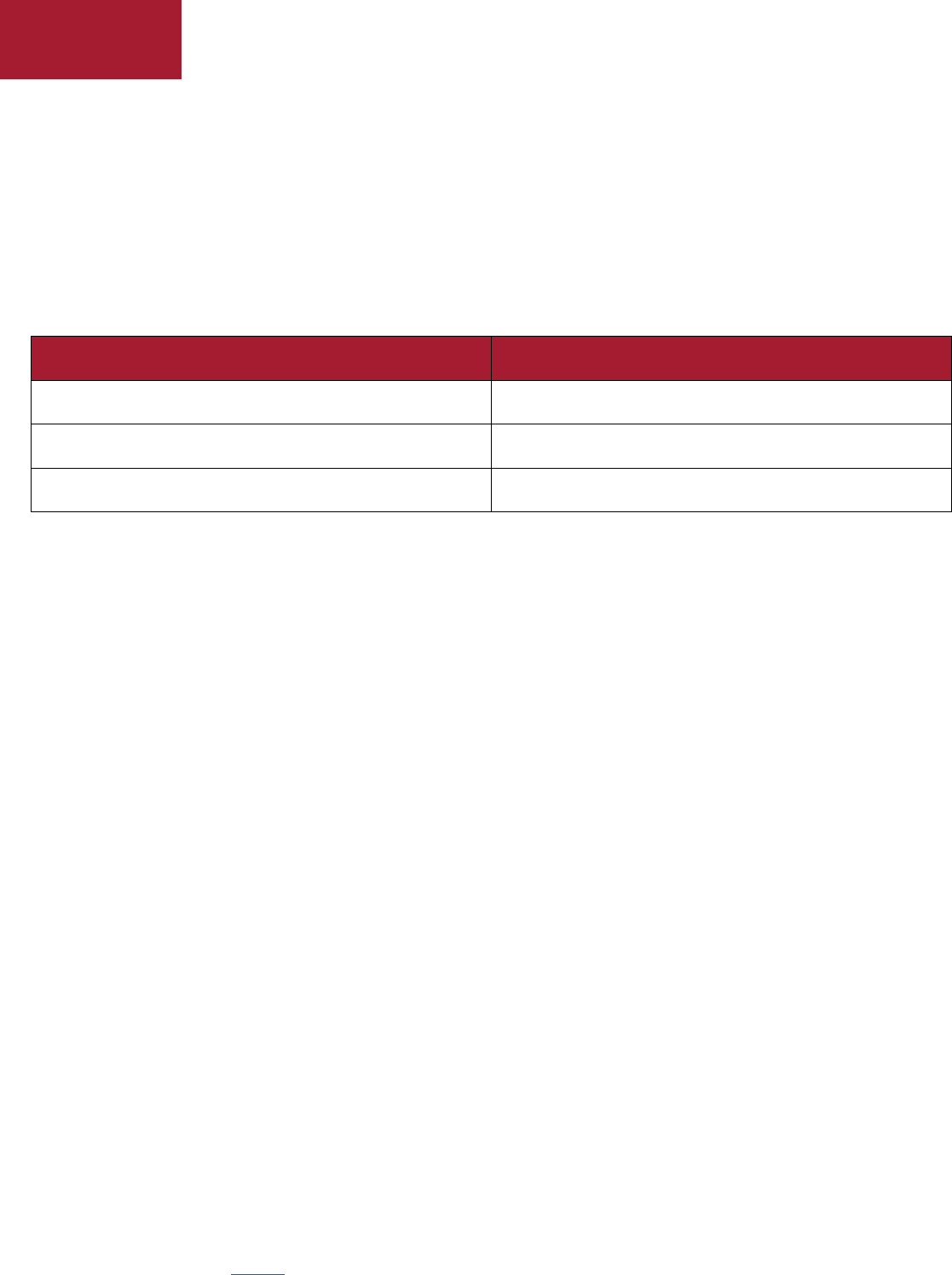

Enrollment Periods and Counting Your Credit Limit

Your per semester credit/course limit under TAP and TRP is available to you for up to three enrollment periods

per calendar year. If you are taking non-Harvard courses on a quarter system and you do not reach your per

quarter credit limit, you cannot transfer unused credits to a fourth enrollment period.

Course Start Date

Semester

January through April

Counts toward spring semester

May through August

Counts toward summer semester

September through December

Counts toward fall semester

Doctoral Fees

Job-related* doctoral dissertation fees are covered under the Tuition Program for up to three semesters. The

semesters need not be taken consecutively. However, academic work must be completed within three years from

the initial semester for which you are charged fees.

* A course is considered to be job-related if it maintains or improves the skills required for an individual’s employment in their

current job at Harvard. See page 10 for more details.

10

Imputed Income and Tax Withholding for Graduate-Credit Courses

Per IRS regulations, tuition benefits that exceed $5,250 in a calendar year for graduate-credit courses are taxable

unless they meet the IRS standard of job-relatedness. Participants need to substantiate the job-relatedness for

each graduate-credit course taken, or indicate the course is not job-related. For courses that do not meet the IRS

standard of job-relatedness, Harvard will impute income, withhold taxes, and report income on TAP benefit

amounts over the annual tax-free limit of $5,250. Refer to the Tuition Program Portal (benstrat.com/Harvard) for

detailed withholding schedule information and deadlines.

Courses taken for undergraduate credit or noncredit are not subject to tax withholding and imputed income.

Verification of Job-Relatedness

Extension School – In addition to registering for courses

online through the Extension School registration portal, you

will need to complete a Graduate Course TAP form via the

Tuition Program Portal (benstrat.com/Harvard). The form

includes a job-relatedness attestation section that you will

need to complete. If you indicate the course meets the IRS

job-relatedness standard, you will need to list the job-related

skills that will be learned in the course. A copy of the form will

be emailed to your manager/supervisor for approval. If the

approval is not received by the stated deadline, the course

will be treated as non-job-related and income will be imputed

and taxes withheld from your paycheck for any tuition benefit

amount in excess of the annual tax-free limit of $5,250. Go to

HARVie (hr.harvard.edu/tuition-assistance) for additional

information.

Other Harvard Participating Schools – You will need to

complete a Graduate Course TAP form via the Tuition Program Portal (benstrat.com/Harvard). The form includes

a job-relatedness attestation section which you will need to complete and submit. You will need to indicate the

job-related skills that will be learned in the course. Once submitted, a copy will be emailed to your

manager/supervisor for approval. If approval is not received by the stated deadline, the course will be treated as

non-job-related and income will be imputed and taxes withheld from your paycheck for any tuition benefit

amount in excess of the annual tax-free limit of $5,250. Go to HARVie (hr.harvard.edu/tuition-assistance) for

additional information.

Non-Harvard Schools – You will need to complete and submit a non-Harvard Graduate Course TRP from the

Tuition Program Portal (benstrat.com/Harvard). The form includes a job-relatedness attestation section that you

will need to complete. You will need to indicate the job-related skills that will be learned in the course. Once

submitted, a copy will be emailed to your manager/supervisor for job-relatedness approval. The completed form,

all supporting documentation, and supervisor approval of job-related courses must be submitted within 60 days

of the last day of the course.

• Employees covered under HUCTW – If you are using TAP and TRP for non-job-related graduate-credit

courses in the same calendar year, your reimbursement under TRP and your TAP benefit will be used in

calculating the imputed income amount.

• Employees NOT covered under HUCTW – Non-Harvard graduate-credit courses MUST meet the IRS

standard of job-relatedness in order to be eligible for reimbursement. Go to page 5 for TRP course

eligibility.

IRS Standard of Job-Relatedness

• The course must help maintain or improve

skills required for the employee’s current

job; or

• The course must be required by Harvard or

by law as a condition of employment in the

employee’s current job

Courses that are needed to meet the minimum

education required for the employee’s current

job, or that are part of a program of study that

will qualify the employee for a new trade do

not meet the IRS standard of job relatedness

and must be treated as taxable.

11

FAQs

What happens if I go on an unpaid leave of absence?

If you go are on unpaid leave of absence as of first day of a Harvard course, you will not be eligible to use TAP for

that course and will be billed the full tuition.

If you are on an unpaid leave of absence at any time during a non-Harvard course, you will not be eligible for

reimbursement through TRP.

What happens if I terminate employment or become ineligible for TAP and TRP after enrolling in a course?

If you are terminated or ineligible as of the first day of a Harvard course, you will not be eligible to use TAP for

that course and will be billed the full tuition.

If you terminate employment or are ineligible at any time during a non-Harvard course, you will not be eligible for

reimbursement through TRP.

I’m in a graduate-degree program. Are the courses taxable?

Depending on the program and your job, all, some, or none of the courses may be taxable if the exceed the

$5,250 annual tax-free limit. You will need to complete the job-relatedness section of the TAP and TRP Form for

each course. Refer to page 10 for more information on tax withholding and imputed income for graduate-credit

courses.

I’m taking a non-Harvard course that is available only as pass/fail. Is it eligible for reimbursement even though

I won’t get a letter grade?

Provided the course is taken for credit and meets all other eligibility criteria outlined on page 5, it may be eligible

for reimbursement. In addition to the other required documentation, you will need to provide a letter from your

school or instructor stating the course is available only as pass/fail and that it was taken for credit. All

documentation must be submitted within 60 days of the last day of the course.

Are there ways to reduce the tax impact for non-job-related graduate-credit courses?

• If you are taking courses for personal enrichment or professional development, but not related to earning

a graduate degree, you should consider registering for undergraduate credit or noncredit where

available.

• For graduate-credit courses, you should consider whether the course is job related and if so, complete

the job-relatedness section of the TAP form when enrolling.

• For courses that are for graduate credit and do not meet the job-related criteria, you should consider

whether the courses can be distributed among more than one calendar year, in a manner that takes

maximum advantage of the $5,250 annual tax-free limit.

I am using the Tuition Reimbursement Plan (TRP) to take courses at another school. Will this impact the

taxability of my TAP benefit?

It depends. For exempt staff, TRP benefits can only be used for courses that are job related, and benefits are

capped at $5,250. However, HUCTW staff may use TRP for courses that are not job related. Both TAP and TRP

benefits for graduate-credit courses that are not job related count towards the annual $5,250 tax-free limit.

Why are taxes being withheld from my paycheck for graduate-credit courses that I dropped/withdrew from?

If you drop the course after the 100% refund period, or withdraw from the course after the 50% refund period,

the University is still paying some or all of the tuition on your behalf; therefore, you are still in receipt of the

benefit. If the course doesn’t meet the IRS standard of job-relatedness, the benefit amount above the $5,250 tax-

free limit is considered taxable income and will be included in your earnings with applicable taxes withheld.

12

Harvard Schools Participating in TAP and Registration Process

Visit the Tuition Program Portal (benstrat.com/Harvard) to complete and print the online TAP Form.

Divinity School

(617)495-5760

www.hds.harvard.edu

Participates in TAP: Yes. You can enroll in courses as a non-degree student.

TAP Fee: 10% of course cost

Confers Degrees or Certificates to TAP Students: Yes, if you are deemed eligible pursuant to the employee

eligibility provisions of the University TAP program, you may use TAP for up to a maximum of 32 units (eight 4-

unit courses).

Registration Process: Bring TAP paperwork to the first day of class to be signed by the instructor. Submit TAP

paperwork to the Assistant Registrar. Contact the Registrar for complete registration information.

Submit materials to: Registrar’s Office

60 Oxford Street

1st Floor

Cambridge, MA 02138

Harvard Schools that do not participate in TAP

• Harvard Business School

• Harvard School of Dental Medicine

•

Executive Education/Professional Development Programs

13

Division of Continuing Education

Extension School

(617)495-4024

www.extension.harvard.edu

Participates in TAP: Yes. You can enroll in courses as a non-degree student.

TAP Fee: $40 per course, or $80 for an 8-credit course

Confers Degrees or Certificates to TAP Students: Yes. You can use TAP toward a degree or certificate.

Registration Process: You can register online at www.extension.harvard.edu. If you have not previously

registered for Extension or Summer School courses, please register as a new student. Your name and date must

match exactly the information on record with the Benefits Office. After choosing your courses, select “Apply TAP”

to complete the online TAP form. Your TAP benefit will be automatically credited to your tuition charges during

the online payment process.

If you do not have access to a computer to register online, please contact the Extension School for assistance.

Graduate-credit courses: In addition to registering online, you must complete and submit a graduate-credit

course TAP form which includes a job-relatedness attestation section. Go to the Harvard Tuition Portal

(benstrat.com/Harvard) for the form and instructions. If the form, and manager/supervisor approval for job-

related courses, is not submitted by the deadline, you will be subject to imputed income and tax withholding on

benefit amounts in excess of $5,250 per calendar year. For information on tax withholding and imputed income

for graduate-credit courses, refer to page 10 of this guide.

January Session: January Session courses count toward the spring term TAP total.

No Refunds of TAP Fee: The TAP fee is nonrefundable unless you have been closed out of all courses or a course

has been cancelled.

Summer School

(617)495-4024

www.summer.harvard.edu

Participates in TAP: Yes. You can enroll in courses as a non-degree student.

TAP Fee: $40 per course, or $80 for an 8-credit course

Confers Degrees or Certificates to TAP Students: No. However, many Summer School courses count toward

Extension School degrees and certificates. See Extension School above.

Registration Process: See Harvard Extension School Registration Process above.

Graduate-credit courses: See Harvard Extension School above

No Refunds of TAP Fee: The TAP fee is nonrefundable unless you have been closed out of all courses or a course

has been cancelled.

14

Faculty of Arts and Sciences (FAS)

Graduate School of Arts and Sciences (GSAS)

Includes Harvard John A. Paulson School of Engineering & Applied Sciences (SEAS)

(617)495-1519

www.gsas.harvard.edu

Participates in TAP: Yes. You can enroll in courses as a non-degree student.

Current TAP Fee: 10% of course cost

Confers Degrees or Certificates to TAP Students: Yes. If admitted to a degree program as a part-time student,

you can use TAP while an employee.

Registration Process:

• Complete the electronic TAP application form for Harvard Courses. Forms are available on the Tuition

Portal (benstrat.com/Harvard)

• Manager/supervisor approval is required for job-related graduate-credit courses

• Once you submit the application, a PDF of the form will be emailed to you from Voya Financial

• Ask the course instructor to sign and print their name on the PDF of your TAP form. Submit the signed PDF

file to [email protected]arvard.edu

Cost of the Course: Your cost is 10% of the course cost. You will be billed this fee after enrollment and payment

can be made through my.harvard. There is no Harvard University payroll deduction for the cost of tuition or fees

that you owe. Please review the FAS Registrar TAP page for additional information.

Deadlines: Please review the FAS Registrar TAP page and TAP Calendar for specific information related to

deadlines and fees.

Additional Information: Former Special Students, or students who have taken FAS courses under TAP, who are

admitted to degree programs may be eligible to apply for academic credit for their Special Student or TAP

coursework after completion of one term in GSAS.

15

Faculty of Arts and Sciences (FAS) Continued

Harvard College Undergraduate

(617)495-1519

www.fas.harvard.edu

Participates in TAP: Yes. You can enroll in courses as a non-degree student.

Current TAP Fee: 10% of course cost

Confers Degrees or Certificates to TAP Students: No. You may take courses using TAP but not towards a Harvard

College degree.

Registration Process:

• Complete the electronic TAP application form for Harvard Courses. Forms are available on the Tuition

Portal (benstrat.com/Harvard)

• Once you submit the application, a PDF of the form will be emailed to you from Voya Financial

• Ask the course instructor to sign and print their name on the PDF of your TAP form. Submit the signed PDF

file to [email protected]arvard.edu

Cost of the Course: Your cost is 10% of the course cost. You will be billed this fee after enrollment and payment

can be made through my.harvard. There is no Harvard University payroll deduction for the cost of tuition or fees

that you owe. Please review the FAS Registrar TAP page for additional information.

Deadlines: Please review the FAS Registrar TAP page and TAP Calendar for specific information related to

deadlines and fees.

Graduate School of Design

(617)496-1237

www.gsd.harvard.edu

Participates in TAP: Yes. You can enroll in courses as a non-degree student.

TAP Fee: 10% of course cost

Confers Degrees or Certificates to TAP Students: No, if admitted to a degree program you cannot use TAP.

Registration Process:

• Fill out the TAP form for Harvard Courses. Forms are available on the Tuition Portal

(benstrat.com/Harvard)

• Manager/supervisor approval is required for job-related graduate-credit courses

• Register for the course via the Graduate School of Design online registration system

• Submit signed TAP form to:

Office of the Registrar

48 Quincy Street, Room 422

Cambridge, MA 02138

16

Graduate School of Education

(617)495-3419

https://registrar.gse.harvard.edu/tuition-assistance-program-tap

Participates in TAP: Yes. You can enroll in courses as a non-degree student. NOTE: The Online Master’s in

Education Leadership program does not participate in TAP.

TAP Fee: 10% of flat rate tuition for part-time students up to your TAP credit limit.

Confers Degrees or Certificates to TAP Students: Yes. If admitted to a degree program you can use TAP.

Exception: You cannot use TAP for the Online Master’s in Education Leadership program. This applies to non-

degree and degree-seeking students.

Registration Process:

• Complete the Non-Degree Registration Poll during the relevant non-degree registration period, for

each semester you intend to take a course (https://registrar.gse.harvard.edu/non-degree-

registration)

• Fill out the TAP form for Harvard Courses. Forms are available on the Tuition Portal

(benstrat.com/Harvard)

• Manager/supervisor approval is required for job-related graduate-credit courses

• Have the instructor for the course sign the TAP form

• The completed TAP forms along with the TAP Fee are due by the relevant semester add/drop

deadline. The TAP fee can be paid via the Student Account (sfs.harvard.edu/student-accounts). The

completed TAP form can be submitted electronically to [email protected]vard.edu

Harvard Law School

(617)495-4612

Email: [email protected]arvard.edu

hls.harvard.edu/registrar/

Participates in TAP: Yes. You may enroll in up to one non-clinical course offering as a non-degree student.

Contact the Law School Registrar’s Office for further information.

TAP Fee: Call the Law School Registrar’s Office

Confers Degrees or Certificates to TAP Students: No. If admitted to a degree program you cannot use TAP.

Additional Eligibility Requirements

1. Must be currently enrolled in a JD program at another ABA-accredited law school

2. Must have fully completed the equivalent of the first year (1L) of law school

3. No 1L or clinical offerings

4. No more than one course per semester

5. Enrollment only if (a) instructor approves, and (b) all HLS students and cross-registrants have seats (i.e.,

equal status with auditors)

Registration Process: Harvard employees applying under the TAP and J.D. students at other law schools who wish

to take one non-clinical upper-level course offered at HLS that is not offered at their law school must contact the

Harvard Law School Registrar’s Office at least two weeks before classes are scheduled to begin.

17

Harvard Medical School

(617)432-1515

www.hms.harvard.edu

Participates in TAP: Yes. You can enroll as a part-time student in any HMS master’s program offering a part-time

option. Additional course offerings available. Check with the Registrar’s Office.

TAP Fee: 10% cost per credit per course.

Confers Degrees or Certificates to TAP Students: Yes, if admitted to a part-time master’s degree program, you

can use TAP.

Registration Process: Complete the TAP form for Harvard Courses. Forms are available on the Tuition Portal

(benstrat.com/Harvard).

Submit materials to: Office of Human Resources

Gordon Hall, Room 150

25 Shattuck Street

Boston, MA 02115

(617) 432-2035

Harvard Kennedy School

(617)495-1155

www.hks.harvard.edu

Participates in TAP: Yes. You can enroll in courses as a non-degree student.

TAP Fee: 10% of course cost

Confers Degrees or Certificates to TAP Students: Yes, Mid-Career Master of Public Administration only. TAP is

not applicable to any other degree programs at Harvard Kennedy School.

Registration Process: Complete the TAP form for Harvard Courses. Forms are available on the Tuition Portal

(benstrat.com/Harvard). Bring the TAP form to class to be signed by the instructor. Return it to the HKS Office of

the Registrar (follow the HKS cross-registration schedule for dates and deadlines).

Submit materials to: Harvard Kennedy School

Office of the Registrar

124 Mount Auburn Street, Suite 165

Cambridge, MA 02138

18

Office for the Arts

Ceramics

(617)495-8680

ofa.fas.harvard.edu/ceramics/

Participates in TAP: Yes

TAP Fee: $40 + lab fees for Ceramics classes

Confers Degrees or Certificates to TAP students: No

Registration Process: Complete one TAP form per

course. Forms are available on the Tuition Portal

(benstrat.com/Harvard). Upload your completed TAP

form with supervisor’s signature to your online

registration account:

https://ofa.asapconnected.com/Default.aspx or

email it to jikim@fas.harvard.edu

Submit materials to: Ceramics Program

224 Western Avenue

Allston, MA 02134

Dance

(617)495-8683

ofa.fas.harvard.edu/dance/

Participates in TAP: Yes

TAP Fee: $40

Confers Degrees or Certificates to TAP students: No

Registration Process: Complete one TAP form per course.

Forms are available on the Tuition Portal

benstrat.com/Harvard). Bring your completed TAP form

with supervisor’s signature. Classes will be determined by

participant’s level of expertise.

Submit materials to: Harvard Dance Center

66 Garden Street

Cambridge, MA 02138

T.H. Chan School of Public Health

(617) 432-1032

Participates in TAP (Non-Degree): Yes. You can enroll in courses as a non-degree student except for Non-degree

PCE.

Current Non-Degree TAP Fee: 10% cost per credit per course.

Confers Degrees or Certificates to TAP students: Yes. You can enroll as a part-time student (up to 10 credits per

semester) in some SM or MPH Programs. See the list of participating programs below. We strongly recommend

contacting the department and secure an academic plan prior to accepting the degree offer. Please review the

HSPH TAP information for tuition calculations.

• MPH45 Academic year, Generalist, or Summer-Focused

• MPH 65

• SM1 in Health Policy Management

• SM1, SM60, or SM80 in Biostatistics

• SM80 in Computational Biology and Quantitative Genetics

• SM1 or SM80 in Epidemiology

• SM60 or SM80 in Health Data Science

Registration Process:

• Non-Degree Students

o Submit the non-degree online application using the Academic Year Non-Degree website

• Degree and Non-Degree Students

o Complete the TAP form and submit it via my.harvard Student Portal under documentation

19

Non-Harvard Course Registration and Reimbursement

The course must be taken toward the completion of a degree if taken for undergraduate credit. All courses for

graduate credit must be job-related* unless you are covered by HUCTW.

You must complete the registration and payment process for the specific college or university that you are

attending.

Covered by HUCTW Bargaining Unit

You will be reimbursed 90% of your out-of-pocket tuition† costs

up to $5,250 per calendar year. You must receive a passing grade

at the institution where the course is taken.

Not Covered by HUCTW Bargaining Unit

You will be reimbursed 75% of your out-of-pocket tuition† costs

up to $5,250 per calendar year. You must receive a grade of C or

better (C- is not eligible) for undergraduate, and B or better (B- is

not eligible) for graduate-credit courses in order to qualify for

reimbursement.

Reimbursement Process

Visit the Tuition Program Portal (benstrat.com/Harvard) for detailed instructions on filing for reimbursement and

to complete the online TRP Form.

Required Documentation

• A completed TRP form

• Manager/supervisor approval for job-related graduate-credit courses

• Copy of your grade from a transcript, letter from the instructor, or mailed copy

• Proof of the cost of the course (bursar’s bill or catalogue page)

• Proof of payment for the course

Submit all paperwork within 60 days of the last day of the course to BSL by uploading it via the Tuition Program

portal. If you are unable to upload your documents you have the following options:

Mail: Voya Financial

PO Box 1300

Manchester, NH 03101

Fax: 603-232-1854

Email: [email protected]om

Incomplete Grades

If you receive an incomplete grade for a course, you must notify BSL or Harvard Benefits within 60 days of

the last day of class to make arrangements for reimbursement upon successful completion of the course.

You must make up the incomplete within the time-frame given to you by the Registrar of the school where you

have received the incomplete grade.

Once you have made up your incomplete, you will need to submit the TAP form and the proper reimbursement

documents to BSL within 60 days of the extended deadline granted by the school.

Non-Harvard Course Reimbursement

Deadline

• All required documentation must be

submitted to Benefit Strategies (BSL)

within 60 days of the last day of the

course. Please see below for

information on incomplete grades.

• If you do not have all required

documentation, you must contact

BSL or Harvard Benefits before the

deadline.

* A course is considered to be job-related if it maintains or improves the skills required for an individual’s employment in their current

job at Harvard.

† To determine out-of-pocket cost, the listed tuition or course cost is reduced by any grants to participant or other funding sources. There is no

reimbursement for fees.

20

Non-Harvard Course Registration and Reimbursement

Reimbursement Timeline

If all required documentation is received by the 15th of the month, your reimbursement will be mailed to you or

deposited to your bank account by the last day of the month.

If all required documentation is received between the 16th of the month and the last day of the month, your

reimbursement will be mailed to you or deposited to your bank account by the 15th of the following month.

HUCTW Education Assistance Fund

The Education Fund assists several educational and career development needs, increasing the

opportunities for support staff to pursue further education.

To be eligible for the Education Fund, you must be part of the HUCTW bargaining unit. For specific

information on the Education Assistance Fund, guidelines, and application contact HUCTW at (617)661-

8289 or go to the HUCTW website - huctw.org/funds-and-loans/education-fund

Tuition Program Contact Information

Harvard Human Resources, Benefits

114 Mt. Auburn Street, 4th Floor Cambridge, MA 02138

Phone: (617)496-4001

Fax: (617)496-3000

Email: benefits@harvard.edu

Voya Financial

PO Box 1300 Manchester, NH 03101

Phone: (855) HVD-FLEX

Fax: (603) 232-1854

Email: hvdtuition@benstrat.com

Although all possible care has been taken in the preparation of this text, any errors or inconsistencies are not binding.

Interpretation of the rules and policies of TAP and TRP are subject to the discretion of the Plan Administrator. The

Tuition Assistance Program and Tuition Reimbursement Program are subject to change without notice.

Revised 08/05/2024