QUARTERLY

RESULTS

PRESENTATION

First Quarter 2024

Q1 | 2024 | 2

FORWARD-LOOKING STATEMENTS

Certain statements in this presentation are

forward-looking statements within the meaning

of the Private Securities Litigation Reform Act

of 1995, and such statements are intended to

qualify for the protection of the safe harbor

provided by the Act. The words “anticipate,”

“estimate,” “continue,” “could,” “approximate,”

“expect,” “objective,” “goal,” “project,” “intend,”

“plan,” “believe,” “will,” “should,” “may,” “target,”

“forecast,” “guidance,” “outlook,” and similar

expressions generally identify forward-looking

statements. Similarly, descriptions of our

objectives, strategies, plans, goals or targets

are also forward-looking statements. Forward-

looking statements relate to the expectations

of management as to future occurrences and

trends, including statements expressing

optimism or pessimism about future operating

results or events and projected sales, earnings,

capital expenditures and business strategy.

Forward-looking statements are based upon a

number of assumptions concerning future

conditions that may ultimately prove to be

inaccurate. Forward-looking statements are

and will be based upon management’s then-

current views and assumptions regarding

future events and operating performance, and

are applicable only as of the dates of such

statements. Although we believe the

expectations expressed in forward-looking

statements are based on reasonable

assumptions within the bounds of our

knowledge, forward-looking statements, by

their nature, involve risks, uncertainties and

other factors, any one or a combination of

which could materially affect our business,

financial condition, results of operations or

liquidity.

Forward-looking statements that we make

herein and in other reports and releases are

not guarantees of future performance and

actual results may differ materially from those

discussed in such forward-looking statements

as a result of various factors, including, but

not limited to, the current economic and credit

conditions, inflation, the cost of goods, our

inability to successfully execute strategic

initiatives, competitive pressures, economic

pressures on our customers and us, the

availability of brand name closeout

merchandise, trade restrictions, freight costs,

the risks discussed in the Risk Factors section

of our most recent Annual Report on Form

10-K, and other factors discussed from time

to time in our other filings with the SEC,

including Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K. This

presentation should be read in conjunction

with such filings, and you should consider all

of these risks, uncertainties and other factors

carefully in evaluating forward-looking

statements.

You are cautioned not to place undue reliance

on forward-looking statements, which speak

only as of the date they are made. We

undertake no obligation to publicly update

forward-looking statements, whether as a

result of new information, future events or

otherwise. You are advised, however, to consult

any further disclosures we make on related

subjects in our public announcements

and SEC filings.

Q1 | 2024 | 3

CEO COMMENT

While we made substantial progress on improving our business operations in Q1, we missed our sales goals

due largely to a continued pullback in consumer spending by our core customers, particularly in high ticket

discretionary items. We remain focused on managing through the current economic cycle by controlling the

controllables. As we move forward, we’re taking aggressive actions to drive positive comp sales growth in

the latter part of the year and into 2025, and to maintain year-over-year gross margin rate improvements,

all driven by progress on our five key actions.

Our operational initiatives to offer a larger assortment of new and exciting extreme bargains, cut costs,

and increase productivity exceeded our targets in Q1. This enabled us to improve consumer perceptions

about our brand and the value we offer, and to deliver a year-over-year improvement in gross margin and

operating expenses, despite significant sales pressure.

Meanwhile, we are pleased with our actions to preserve and enhance liquidity in Q1, which included

aggressive efforts to manage opex, capex and inventory, and the execution of a new $200 million term

loan facility, which provides us with significant additional financial flexibility.

While near-term conditions have been challenging, we’re not slowing down on making progress to

transform our business. The current financial performance does not yet reflect the stronger business

model that we’ve created through our five key actions, but we expect the fruits of those efforts to become

more apparent in the back half of the year.

Bruce Thorn, President & CEO

FIRST

QUARTER

RESULTS

First Quarter 2024

Q1 | 2024 | 5

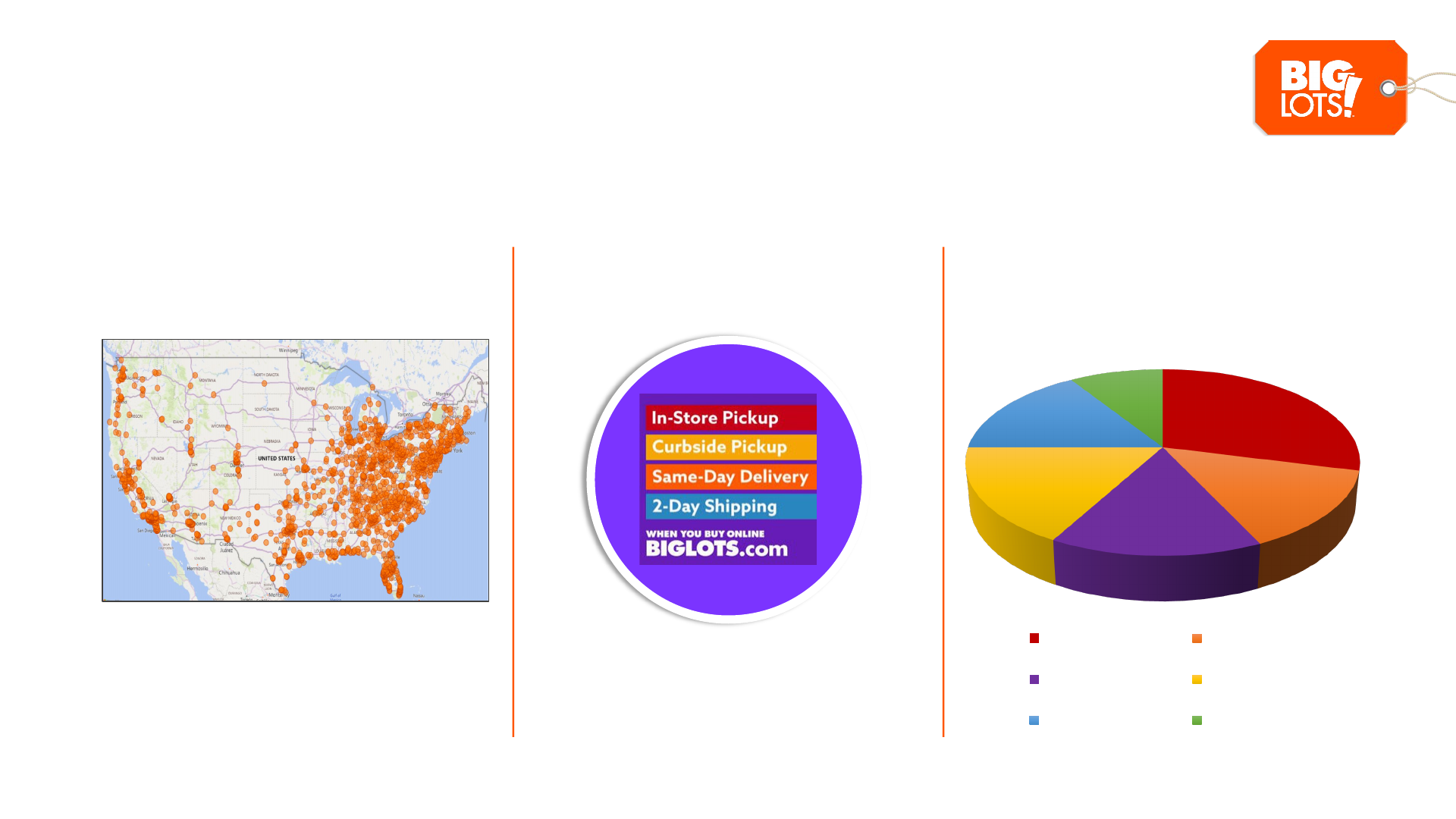

BIG LOTS AT A GLANCE

Strong Omnichannel

Capabilities

Diversified Category

Mix

National Store

Footprint

1,390 Stores in 48 States Industry-leading delivery options, easy

checkout, and multiple payment types

to win customers for life

29%

14%

15%

17%

16%

9%

Furniture Food

Soft Home Consumables

Seasonal Hard Home

Chart based on Q1 2024 sales

Q1 | 2024 | 6

FIRST QUARTER SUMMARY

Impacted by challenging

consumer environment

Up 190bps vs. LY

-12.7%

Inventory vs. LY

In line with guidance,

continued turn

improvement

-3.6%

Adjusted

operating

expense

1

vs. LY

Ahead of guidance

-9.9%

Comps

36.8%

Gross margin

1

Adjusted Operating Expenses are comprised of adjusted Selling and Administrative Expenses, adjusted Depreciation Expense, and adjusted Gain on Sale

of Real Estate. Adjusted results are non-GAAP financial measures. A reconciliation of reported GAAP results to the adjusted non-GAAP results is

included in the appendix.

Q1 | 2024 | 7

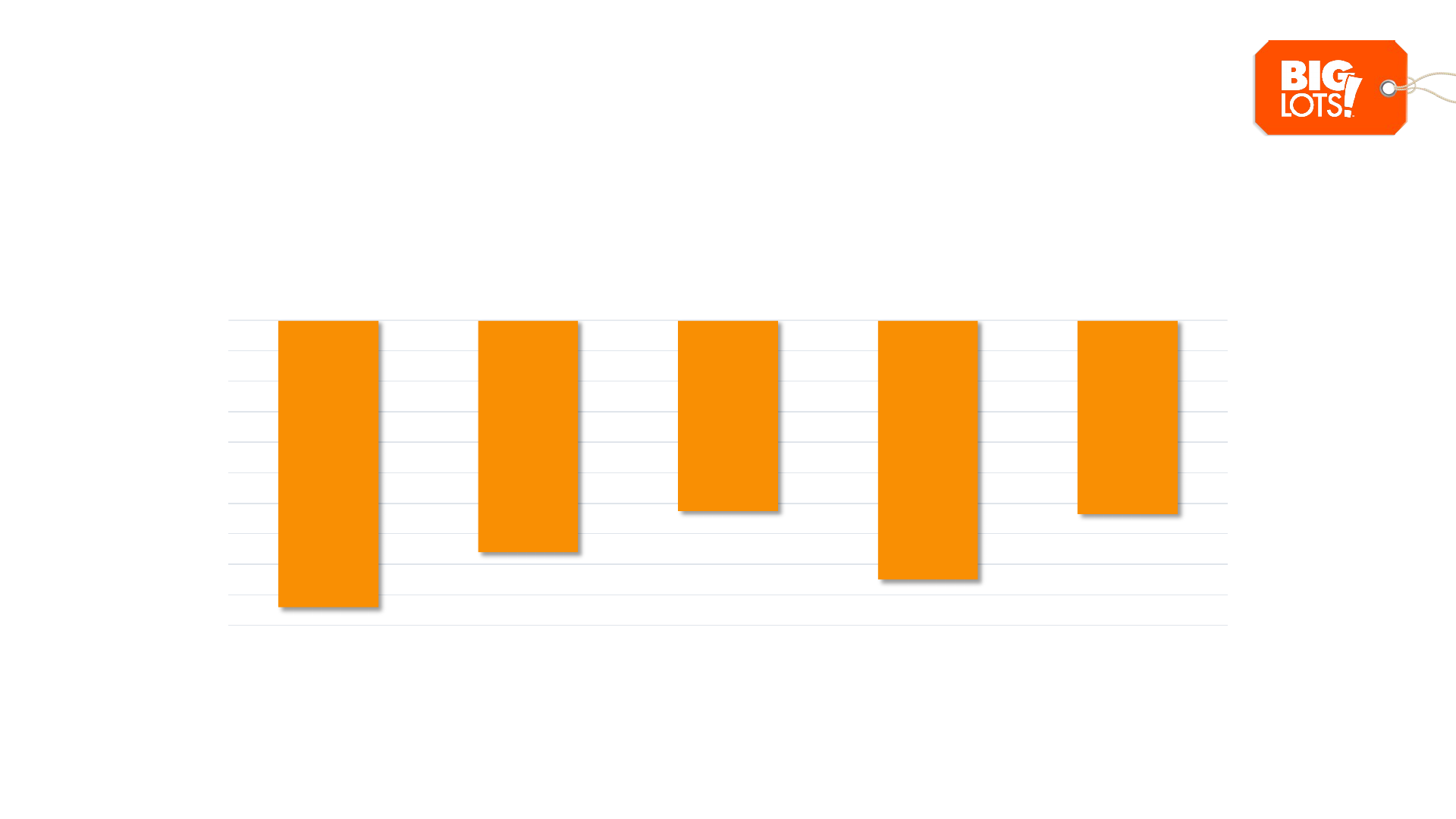

Q1 2024 COMP SALES BY CATEGORY

-16%

-14%

-12%

-10%

-8%

-6%

-4%

-2%

0%

Seasonal Hard Home Soft Home Food Consumab les Furniture Total

-15%

-14%

-11%

-10%

-8%

-6%

-10%

Comp Sales Impacted by Soft Consumer Environment

Note: In the Q4 2023, we realigned our merchandise categories and eliminated our Apparel, Electronics, & Other merchandise category. We have reallocated the departments

that previously comprised Apparel, Electronics, & Other into the following merchandise categories: Hard Home, Soft Home, Consumables, and Food.

Q1 | 2024 | 8

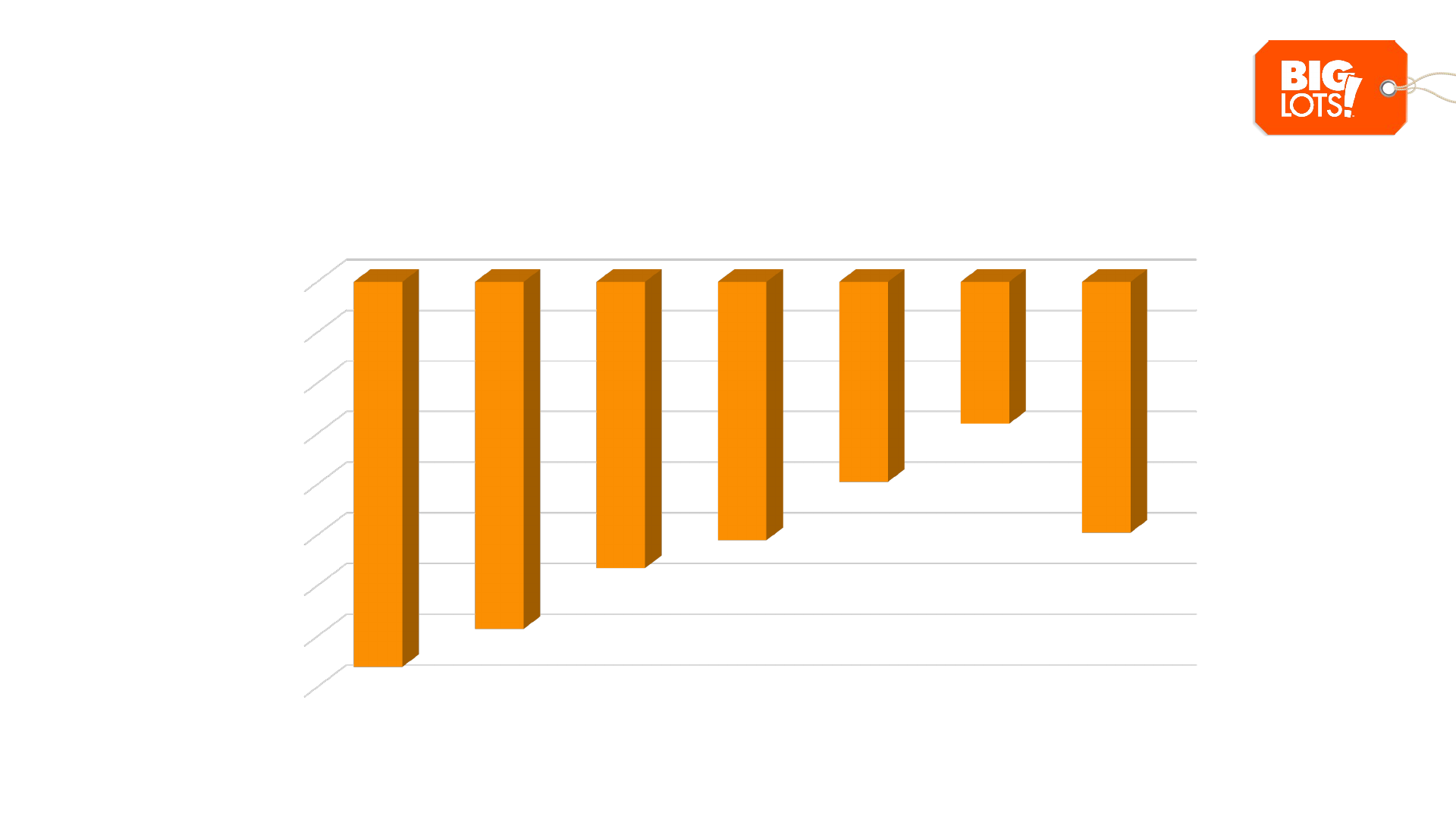

YEAR-OVER-YEAR INVENTORY REDUCTION

Inventory Managed Down More than Q1 Sales

-18.8%

-15.2%

-12.5%

-17.0%

-12.7%

Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024

Q1 | 2024 | 9

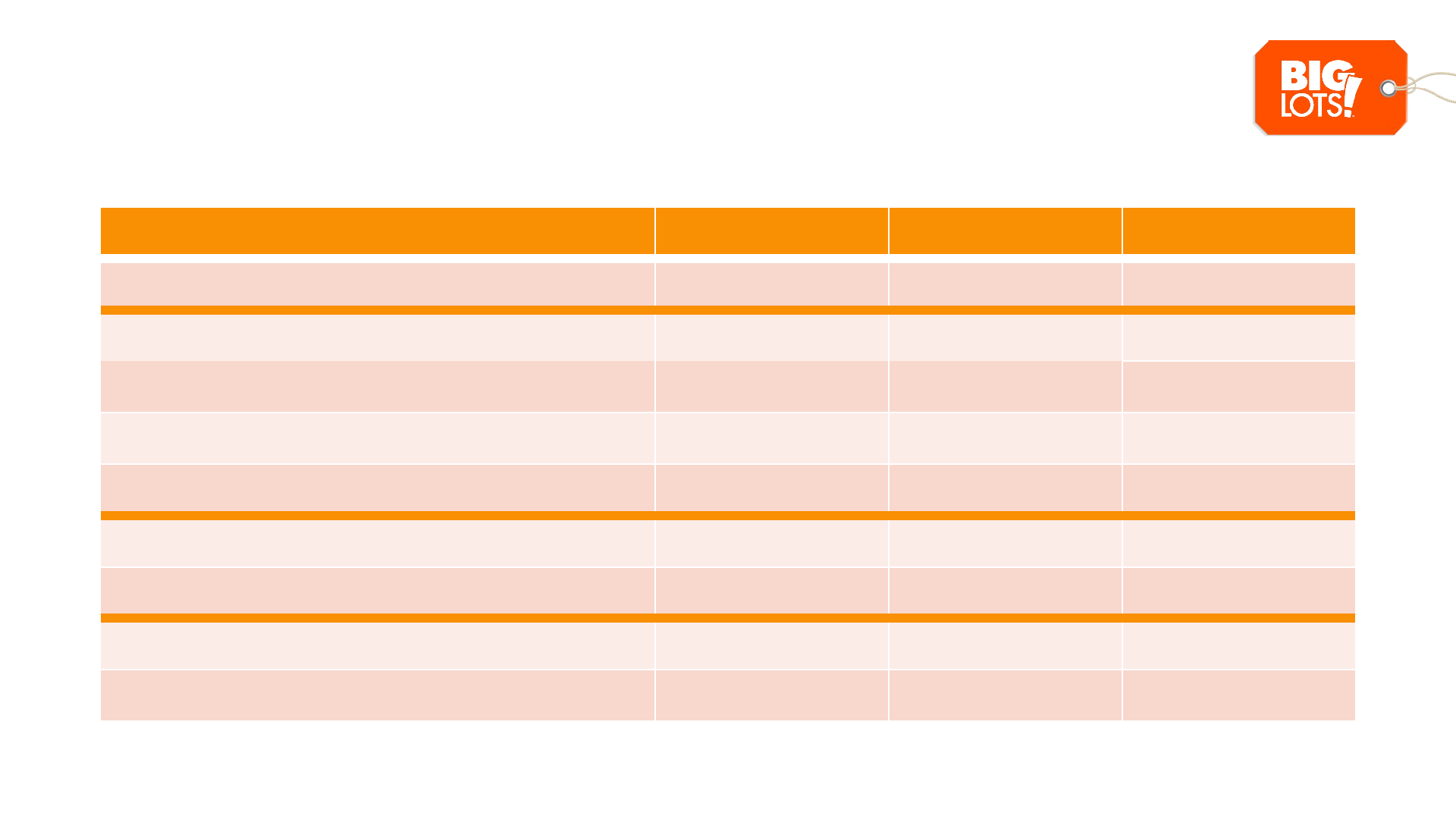

ADJUSTED Q1 2024 INCOME STATEMENT

Q1 2024 Q1 2023 Change vs. 2023

Net Sales

$1,009,112 $1,123,477 (10.2%)

Gross Margin

371,699 392,469

Gross Margin Rate

36.8% 34.9% 190 bps

Adjusted Operating Expenses

(1)(2)

491,848 510,455

Adjusted Operating Expense Rate

(2)

48.7% 45.4% 330 bps

Adjusted Operating Profit (Loss)

(2)

($120,149) ($117,986)

Adjusted Operating Profit (Loss) Rate

(2)

(11.9%) (10.5%) (140 bps)

Adjusted Diluted (Loss) Earnings Per Share

(2)

($4.51) ($3.40)

Diluted Weighted Average Shares

29,350 29,018

(In thousands, except for earnings per share)

(1) Adjusted Operating Expenses are comprised of adjusted Selling and Administrative Expenses, adjusted Depreciation Expense, and adjusted Gain on Sale of Real Estate.

(2) Adjusted 2024 and 2023 results are non-GAAP financial measures. A reconciliation of reported GAAP results to the adjusted non-GAAP results is included in the appendix.

Q1 | 2024 | 10

CAPITAL ALLOCATION

*Net liquidity is defined as ABL Credit Facility availability and FILO Term Loan availability, net of covenant-based borrowing limitations, plus Cash and

Cash Equivalents.

~$60M

FY2024 CAPEX

Guidance

$900M

ABL Credit Facility

Increased Borrowing

Capacity by Up to

$200M

In line with or somewhat

below FY 2023 spend

Through new FILO term loan

facility in April

Net liquidity of

~$289M* at end of Q1

GUIDANCE

Second Quarter 2024

Q1 | 2024 | 12

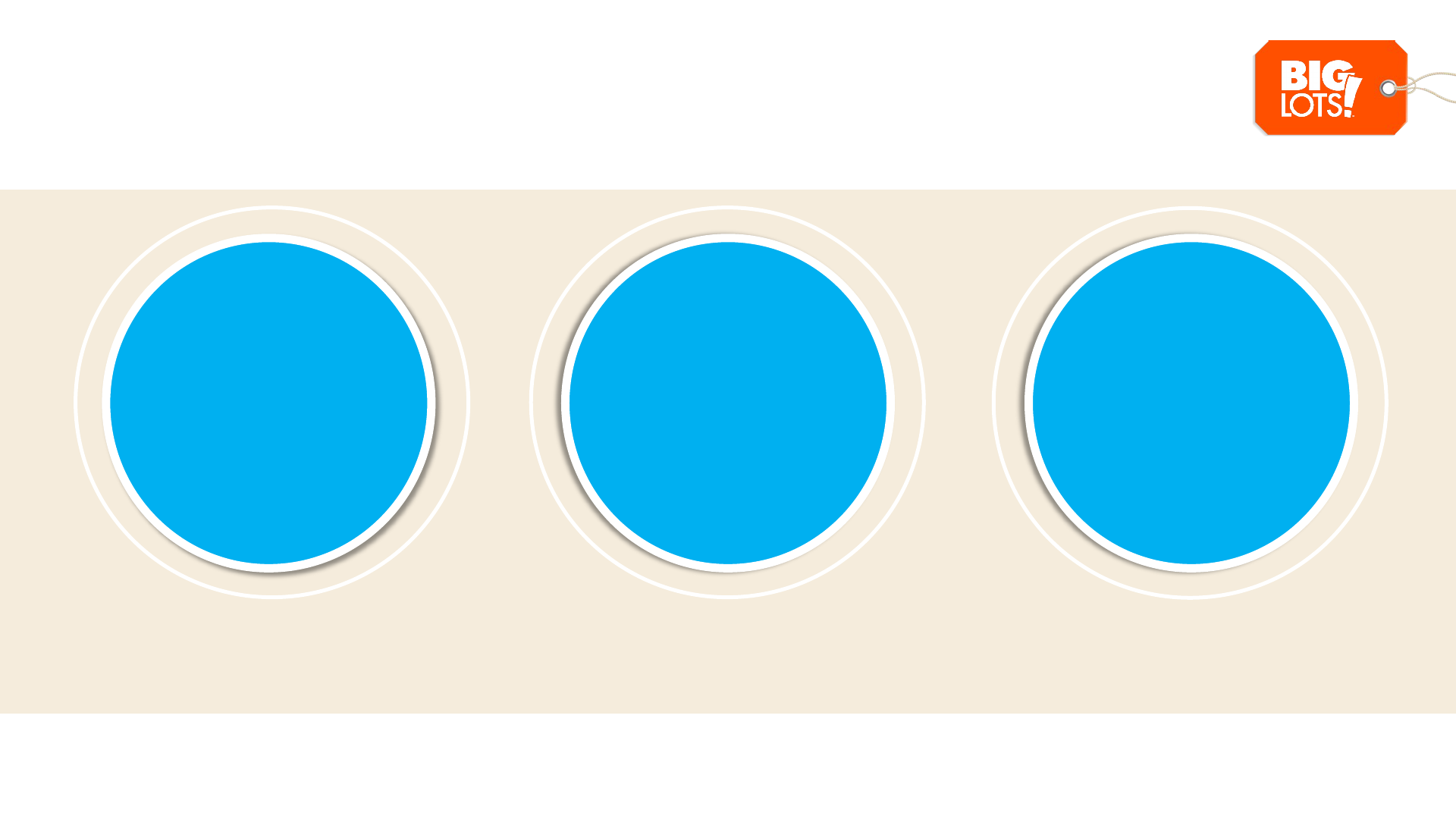

Q2 2024 GUIDANCE

SG&A

REDUCTION

COMP SALES

GROSS MARGIN

IMPROVEMENT

Down low to mid-single-digit

range, inclusive of

sale/leaseback expense

Significant improvement versus

last year, up by at least 300

basis points

Down mid to high-single-

digit range; sequential

improvement

Q1 | 2024 | 13

5 KEY ACTIONS

Q1 | 2024 | 14

PROJECT SPRINGBOARD

Raising cumulative run rate

target to $185M (vs.

~$175M previously) by

end of 2024

~40%

of savings in

other gross

margin items

Inventory optimization,

marketing, pricing &

promotions

~20%

of savings

in SG&A

Store & field operations,

supply chain, general

office

$200M+

Bottom-line

opportunities

~40%

of savings

in COGS

WRAP-UP

Q1 | 2024 | 16

Q1 WRAP UP

• Comparable sales decline of 9.9% in Q1, impacted by challenging consumer environment; GAAP EPS of -$6.99, with adjusted EPS

loss of -$4.51 due to year-over-year sales decline and continued cost pressures

• Successfully reduced inventory, down more than sales

• Comps expected to improve sequentially in Q2; focused on unlocking additional sales opportunities (e.g., more bargains and extreme

bargains, exciting assortment, clearer value communication)

• Expect significant gross margin improvement through the year, driven by reduced markdown activity and benefits from Project

Springboard efforts

• Continue advancing five key actions to drive improvements through 2024, with a path to positive comparable sales by end of year

• Project Springboard on track to deliver bottom-line opportunity of $200M+ in gross margin/SG&A; expect to be at $185M by the

end of 2024

• Enhanced liquidity through new $200M FILO Term Loan

• Despite challenging conditions, will continue making progress to transform the business through our five key actions

APPENDIX

Q1 | 2024 | 18

FIRST QUARTER 2024 GAAP TO NON-GAAP RECONCILIATION

($ in thousands, except for earnings per share)

The above adjusted selling and administrative expenses, adjusted selling and administrative expense rate, adjusted operating loss, adjusted operating loss rate, adjusted income tax

expense (benefit), adjusted effective income tax rate, adjusted net loss, and adjusted diluted earnings (loss) per share are “non-GAAP financial measures” as that term is defined

by Rule 101 of Regulation G (17 CFR Part 244) and Item 10 of Regulation S-K (17 CFR Part 229). These non-GAAP financial measures exclude from the most directly

comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) FDC closing costs

and related expenses of $874, store asset impairment charges of $68,245, and fees related to a cost reduction and productivity initiative which we refer to as “Project

Springboard” of $3,588.

As Reported

Adjustment to exclude

forward distribution center

("FDC") closing costs and

related expenses

Adjustment to

exclude store asset

impairment charges

Adjustment to

exclude fees

related to a cost

reduction and

productivity

initiative

As Adjusted

(non-GAAP)

Selling and administrative expenses

533,004$ (874)$ (68,245)$ (3,588)$ 460,297$

Selling and administrative expense rate

52.8% (0.1%) (6.8%) (0.4%) 45.6%

Operating loss

(192,856) 874 68,245 3,588 (120,149)

Operating loss rate

(19.1%) 0.1% 6.8% 0.4% (11.9%)

Income tax expense (benefit)

191 - - - 191

Effective income tax rate

(0.1%) - - - (0.1%)

Net loss

(205,035) 874 68,245 3,588 (132,328)

Diluted earnings (loss) per share

(6.99)$ 0.03$ 2.33$ 0.12$ (4.51)$

Q1 | 2024 | 19

FIRST QUARTER 2023 GAAP TO NON-GAAP RECONCILIATION

($ in thousands, except for earnings per share)

The above adjusted selling and administrative expenses, adjusted selling and administrative expense rate, adjusted depreciation expense, adjusted depreciation expense rate, adjusted gain on sale of real estate, adjusted

gain on sale of real estate rate, adjusted operating loss, adjusted operating loss rate, adjusted income tax expense (benefit), adjusted effective income tax rate, adjusted net loss, and adjusted diluted earnings (loss)

per share are “non-GAAP financial measures” as that term is defined by Rule 101 of Regulation G (17 CFR Part 244) and Item 10 of Regulation S-K (17 CFR Part 229). These non-GAAP financial measures exclude

from the most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) synthetic lease exit costs and

related expenses of $53,567 ($39,754, net of tax), FDC contract termination costs and related expenses of $9,617 ($7,137, net of tax), store asset impairment charges of $83,808 ($63,365, net of tax), and a

gain on sale of real estate and related expenses of $3,799 ($2,900, net of tax).

Our management believes that the disclosure of these non-GAAP financial measures provides useful information to investors because the non-GAAP financial measures present an alternative and more relevant method

for measuring our operating performance, excluding special items included in the most directly comparable GAAP financial measures, that management believes is more indicative of our on-going operating results and

financial condition. Our management uses these non-GAAP financial measures, along with the most directly comparable GAAP financial measures, in evaluating our operating performance.

As Reported

Adjustment to

exclude synthetic

lease exit costs and

related expenses

Adjustment to exclude

forward distribution center

("FDC") contract termination

costs and related expenses

Adjustment to

exclude store asset

impairment charges

Adjustment to

exclude gain on sale

of real estate and

related expenses

As Adjusted

(non-GAAP)

Selling and administrative expenses

620,865$ (53,567)$ (8,624)$ (83,808)$ -$ 474,866$

Selling and administrative expense rate

55.3% (4.8%) (0.8%) (7.5%) - 42.3%

Depreciation expense

36,582 - (993) - - 35,589

Depreciation expense rate

3.3% - (0.1%) - - 3.2%

Gain on sale of real estate

(3,799) - - - 3,799 -

Gain on sale of real estate rate

(0.3%) - - - 0.3% -

Operating loss

(261,179) 53,567 9,617 83,808 (3,799) (117,986)

Operating loss rate

(23.2%) 4.8% 0.9% 7.5% (0.3%) (10.5%)

Income tax expense (benefit)

(64,250) 13,813 2,480 20,443 (899) (28,413)

Effective income tax rate

23.8% (0.6%) (0.1%) (0.9%) 0.1% 22.3%

Net loss

(206,073) 39,754 7,137 63,365 (2,900) (98,717)

Diluted earnings (loss) per share

(7.10)$ 1.37$ 0.25$ 2.18$ (0.10)$ (3.40)$