Q3 | 2023 | 1

QUARTERLY RESULTS

PRESENTATION

THIRD QUARTER 2023

Q3 | 2023 | 2

FORWARD-LOOKING STATEMENTS

Certain statements in this presentation are forward-

looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, and

such statements are intended to qualify for the

protection of the safe harbor provided by the Act.

The words “anticipate,” “estimate,” “continue,”

“could,” “approximate,” “expect,” “objective,” “goal,”

“project,” “intend,” “plan,” “believe,” “will,” “should,”

“may,” “target,” “forecast,” “guidance,” “outlook,”

and similar expressions generally identify forward-

looking statements. Similarly, descriptions of our

objectives, strategies, plans, goals or targets are

also forward-looking statements. Forward-looking

statements relate to the expectations of

management as to future occurrences and trends,

including statements expressing optimism or

pessimism about future operating results or events

and projected sales, earnings, capital expenditures

and business strategy. Forward-looking statements

are based upon a number of assumptions

concerning future conditions that may ultimately

prove to be inaccurate. Forward-looking statements

are and will be based upon management’s then-

current views and assumptions regarding future

events and operating performance, and are

applicable only as of the dates of such statements.

Although we believe the expectations expressed in

forward-looking statements are based on

reasonable assumptions within the bounds of our

knowledge, forward-looking statements, by their

nature, involve risks, uncertainties and other factors,

any one or a combination of which could materially

affect our business, financial condition, results of

operations or liquidity.

Forward-looking statements that we make herein

and in other reports and releases are not

guarantees of future performance and actual results

may differ materially from those discussed in such

forward-looking statements as a result of various

factors, including, but not limited to, the current

economic and credit conditions, inflation, the cost

of goods, our inability to successfully execute

strategic initiatives, competitive pressures,

economic pressures on our customers and us, the

availability of brand name closeout merchandise,

trade restrictions, freight costs, the risks discussed in

the Risk Factors section of our most recent Annual

Report on Form 10-K, and other factors discussed

from time to time in our other filings with the SEC,

including Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K. This presentation

should be read in conjunction with such filings, and

you should consider all of these risks, uncertainties

and other factors carefully in evaluating forward-

looking statements.

You are cautioned not to place undue reliance on

forward-looking statements, which speak only as of

the date they are made. We undertake no

obligation to publicly update forward-looking

statements, whether as a result of new information,

future events or otherwise. You are advised,

however, to consult any further disclosures we make

on related subjects in our public announcements

and SEC filings.

Q3 | 2023 | 3Q3 | 2023 | 3

THIRD QUARTER RESULTS

GUIDANCE

WRAP-UP

APPENDIX

Q3 | 2023 | 4Q3 | 2023 | 4

Although the environment remains challenging, we continued to make significant

progress in turning around our business. Our key strategic actions are building

momentum and we continue to play offense with our efforts to deliver incredible

bargains and communicate unmistakable value. As a result, we are now on track to

deliver an adjusted Q4 operating result ahead of last year, which would mark the first

quarter of year-over-year improvement in nearly three years, and we expect quarterly

year-over-year improvements to continue through 2024.

As it relates to Q3 results, we were able to deliver on or exceed our beginning of quarter

guidance on all key metrics. We believe the improvements in Q3 were driven by the five

key actions that underlie our strategy, which are to own bargains, communicate

unmistakable value, increase store relevance, win with omnichannel, and drive

productivity.

To support our ongoing turnaround, our efforts to aggressively manage costs, inventory

and capital expenditures, as well as monetize our assets, have allowed us to significantly

strengthen our balance sheet. Our ongoing efforts are providing us with ample liquidity

to weather the macroeconomic challenges, even if they are prolonged. We expect to

generate substantial free cash flow and significantly reduce outstanding debt in the

fourth quarter.

Bruce Thorn, President & CEO

CEO COMMENT

Q3 | 2023 | 5

Q3 | 2023 | 5

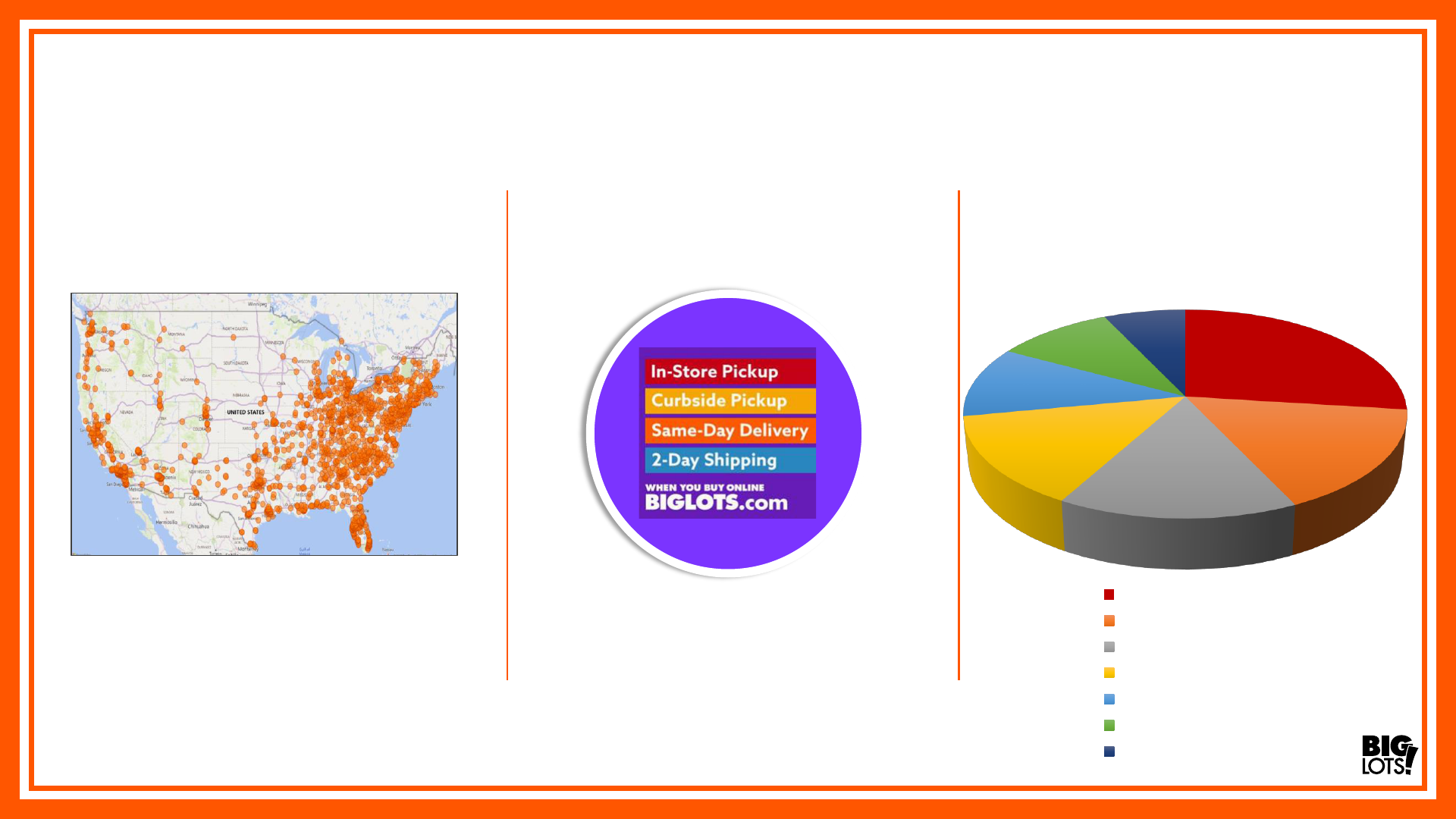

27%

16%

15%

14%

11%

10%

7%

Furniture

Food

Soft Home

Consumables

Seasonal

The Lot, Apparel, Electronics, etc.

Hard Home

Chart based on Q3 2023 sales

Diversified Category

Mix

National Store

Footprint

Industry-leading delivery

options, easy checkout, multiple

payment types; new order

management system to improve

shipping times and product

availability

Strong Omnichannel

Capabilities

1,428 Stores in 48 States

BIG LOTS AT A GLANCE

Q3 | 2023 | 6

Inline with Guidance

Ahead of Guidance,

Up 240bps vs. LY

$1.18B

Inventory at the

end of Q2

Inline with Guidance,

Managed Down Similar

to Sales Decline

-6.0%

Adjusted

operating

expense

1

vs. LY

Ahead of Guidance

-13.2%

Comps

36.4%

Gross margin

THIRD QUARTER SUMMARY

1

Adjusted Operating Expenses are comprised of adjusted Selling and Administrative Expenses and Adjusted Depreciation Expense. Adjusted 2023 results

are non-GAAP financial measures. A reconciliation of reported GAAP results to the adjusted non-GAAP results is included in the appendix.

Q3 | 2023 | 7

Q3 | 2023 | 7

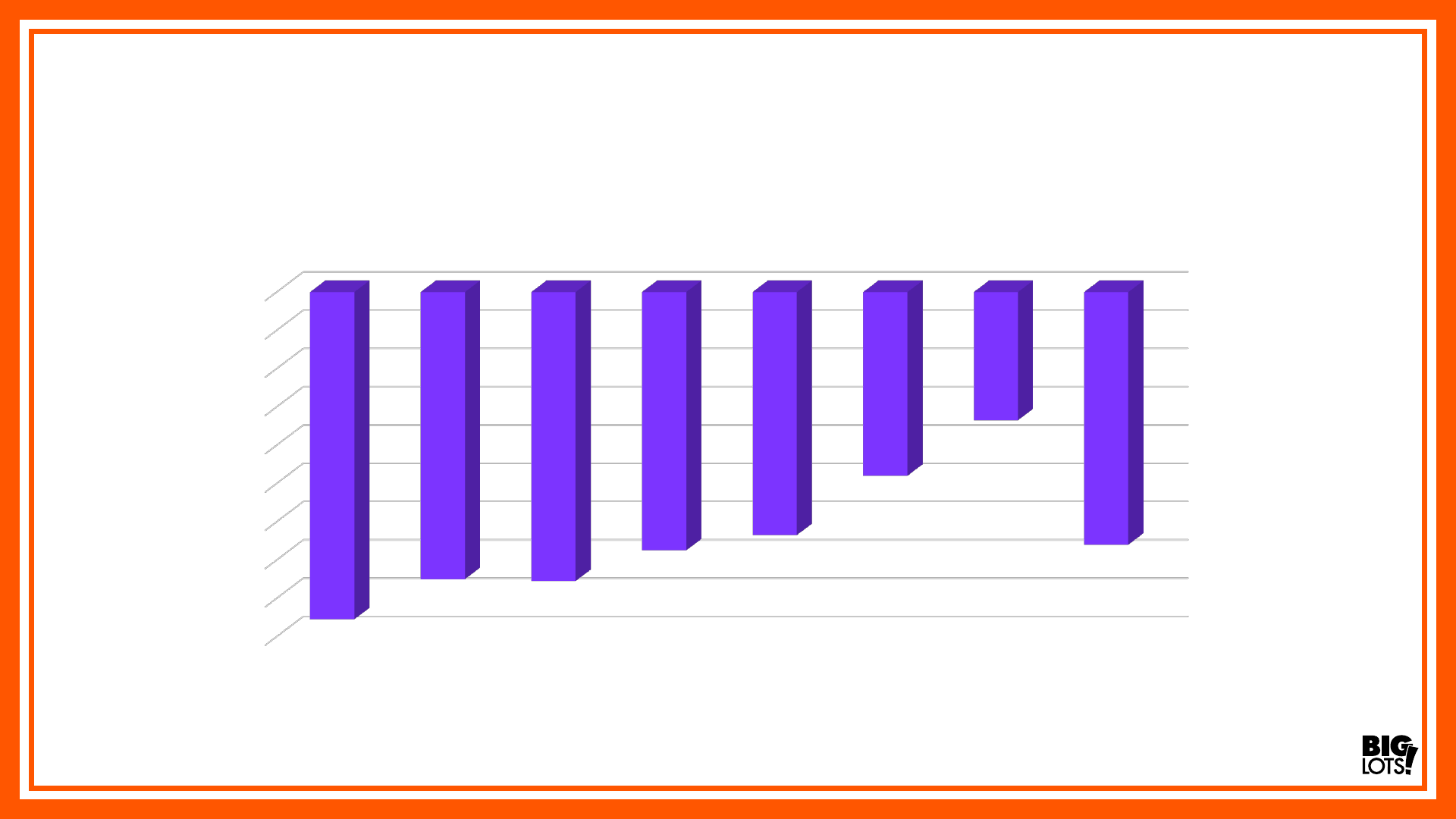

Q3 2023 COMP SALES BY CATEGORY

Sequential Improvements Relative to Q2 in Seasonal and Furniture

Furniture Seasonal Hard Home Soft Home The Lot,

Apparel,

Electronics

Food Consumables Total

-17%

-15%

-15%

-14%

-13%

-10%

-7%

-13%

Q3 | 2023 | 8

Q3 | 2023 | 8

INVENTORY MANAGED DOWN IN LINE WITH Q3 SALES

5.3%

-7.3%

-18.8%

-15.2%

-12.5%

Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023

YOY Inventory Growth (Decline)

Q3 | 2023 | 9

Q3 | 2023 | 9

Net Sales

Gross Margin

Gross Margin Rate

Adjusted Operating Expenses

(1)(2)

Adjusted Operating Expense Rate

(2)

Adjusted Operating Loss

(2)

Adjusted Operating Loss Rate

(2)

Adjusted Diluted (Loss) Earnings Per Share

(2)

Diluted Weighted Average Shares

ADJUSTED Q3 2023 SUMMARY INCOME STATEMENT

(In thousands, except for earnings per share)

(1) Adjusted Operating Expenses are comprised of adjusted Selling and Administrative Expenses and Adjusted Depreciation Expense.

(2) Adjusted 2023 and 2022 results are non-GAAP financial measures. A reconciliation of reported GAAP results to the adjusted non-GAAP results is included in the appendix.

Q3 2023

$1,026,677

373,815

36.4%

487,666

47.5%

($113,851)

(11.1%)

($4.38)

29,204

Q3 2022

$1,204,281

409,460

34.0%

518,548

43.1%

($109,088)

(9.1%)

($2.99)

28,943

Change

vs. 2022

(14.7%)

240 bps

440 bps

(200) bps

Q3 | 2023 | 10

Q3 | 2023 | 10

Net Sales

Gross Margin

Gross Margin Rate

Adjusted Operating Expenses

(1)(2)

Adjusted Operating Expense Rate

(2)

Adjusted Operating Loss

(2)

Adjusted Operating Loss Rate

(2)

Adjusted Diluted (Loss) Earnings Per Share

(2)

Diluted Weighted Average Shares

ADJUSTED YTD 2023 SUMMARY INCOME STATEMENT

(In thousands, except for earnings per share)

(1) Adjusted Operating Expenses are comprised of adjusted Selling and Administrative Expenses, Adjusted Depreciation Expense, and Adjusted Gain on sale of real estate.

(2) Adjusted 2023 and 2022 results are non-GAAP financial measures. A reconciliation of reported GAAP results to the adjusted non-GAAP results is included in the appendix.

YTD 2023

$3,289,615

1,142,168

34.7%

1,485,920

45.2%

($343,752)

(10.4%)

($11.02)

29,132

YTD 2022

$3,925,216

1,352,602

34.5%

1,560,219

39.7%

($207,617)

(5.3%)

($5.68)

28,828

Change

vs. 2022

(16.2%)

20 bps

550 bps

(510) bps

Q3 | 2023 | 11

~$75M

FY2023 CAPEX

CAPITAL ALLOCATION

$306M

Asset

Monetization

$900M

ABL Credit

Facility

vs. initial guidance of ~$100M in

March 2023

Net available liquidity of ~$258M*

at end of Q3

Gross proceeds relating to

sale/leaseback of California DC

and 23 owned stores

*Net liquidity is defined as ABL Credit Facility availability, net of covenant-based borrowing limitations, plus Cash and Cash Equivalents.

Q3 | 2023 | 12Q3 | 2023 | 12

THIRD QUARTER RESULTS

GUIDANCE

WRAP-UP

APPENDIX

Q3 | 2023 | 13

COMP SALES

GROSS MARGIN

IMPROVEMENT

SG&A

REDUCTION

Down high-single-digit range;

continued sequential

improvement

Significant improvement

versus last year to

approximately 38%

Structural SG&A savings of over

$100M for FY2023, prior to

initial Project Springboard

benefits

Q4 2023 GUIDANCE

Q3 | 2023 | 14

FIVE KEY ACTIONS

Q3 | 2023 | 15

On track to deliver a high

proportion of the benefits

in 2024

~40%

of savings in

other gross

margin items

Inventory optimization,

marketing, pricing &

promotions

~20%

of savings in

SG&A

Store & field operations,

supply chain, general office

$200M+

Bottom-line

opportunities

~40%

of savings in

COGS

PROJECT SPRINGBOARD

Q3 | 2023 | 16Q3 | 2023 | 16

THIRD QUARTER RESULTS

GUIDANCE

WRAP-UP

APPENDIX

Q3 | 2023 | 17

Q3 WRAP-UP

• Comparable sales decline of 13.2% in Q3, in line with our guidance range; GAAP EPS of $0.16, with adjusted EPS loss of

$4.38 due to year-over-year sales decline and continued cost pressures

• Successfully reduced inventory in line with sales

• Comps to continue to improve sequentially in Q4; focused on unlocking additional sales opportunities (e.g., more

bargains and extreme bargains, exciting assortment, clearer value communication)

• Q4 gross margin continues to improve vs. last year, driven by more normalized markdown activity, lower freight costs, and

cost savings initiatives

• Q4 adjusted operating result expected to be ahead of last year, marking the first quarter of year-over-year improvement

since Q1 2021

• Project Springboard on track to deliver bottom-line opportunity of $200M+ in gross margin/SG&A; high proportion of the

benefits expected to be realized by the end of 2024

• Strengthened liquidity through $306M asset monetization

• Continue advancing five key actions to sequentially improve business results and drive quarterly year over year

improvements through 2024

Q3 | 2023 | 18Q3 | 2023 | 18

THIRD QUARTER RESULTS

GUIDANCE

WRAP-UP

APPENDIX

Q3 | 2023 | 19

Q3 | 2023 | 19

THIRD QUARTER 2023 GAAP TO NON-GAAP RECONCILIATION

The above adjusted selling and administrative expenses, adjusted selling and administrative expense rate, adjusted gain on sale of real estate, adjusted gain on sale of real estate rate, adjusted operating profit (loss),

adjusted operating profit (loss) rate, adjusted income tax expense (benefit), adjusted effective income tax rate, adjusted net income (loss), and adjusted diluted earnings (loss) per share are “non-GAAP financial

measures” as that term is defined by Rule 101 of Regulation G (17 CFR Part 244) and Item 10 of Regulation S-K (17 CFR Part 229). These non-GAAP financial measures exclude from the most directly comparable

financial measures calculated and presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) FDC contract termination costs and related expenses of $2,752, store

asset impairment charges net of liability extinguishment for terminated leases of previously impaired stores of $53,990, a gain on sale of real estate and related expenses of $204,719 ($203,840, net of tax), and fees

related to a cost reduction and productivity initiative which we refer to as “Project Springboard” of $14,444.

Our management believes that the disclosure of these non-GAAP financial measures provides useful information to investors because the non-GAAP financial measures present an alternative and more relevant

method for measuring our operating performance, excluding special items included in the most directly comparable GAAP financial measures, that management believes is more indicative of our on-going operating

results and financial condition. Our management uses these non-GAAP financial measures, along with the most directly comparable GAAP financial measures, in evaluating our operating performance.

($ in thousands, except for earnings per share)

As reported

As adjusted

(non-GAAP)

Selling and administrative expenses

Selling and administrative expense rate

Gain on sale of real estate

Gain on sale of real estate

Operating profit (loss)

Operating profit (loss) rate

Income tax expense (benefit)

Effective income tax rate

Net income (loss)

Diluted earnings (loss) per share

$525,730

51.2%

(204,719)

(19.9%)

19,682

1.9%

1,347

22.1%

4,743

$0.16

$454,544

44.3%

-

-

(113,851)

(11.1%)

468

(0.4%)

(127,911)

($4.38)

APPENDIX

Adjustment to

exclude gain on

sale of real estate

and related

expenses

-

-

204,719

19.9%

(204,719)

(19.9%)

(879)

(22.5%)

(203,840)

($6.98)

($2,752)

(0.3%)

-

-

2,752

0.3%

-

-

2,752

$0.09

Adjustment to

exclude forward

distribution center

("FDC") contract

termination costs

and related expenses

($53,990)

(5.3%)

-

-

53,990

5.3%

-

-

53,990

$1.85

Adjustment to

exclude store

asset

impairment

charges

Adjustment to

exclude fees

related to a cost

reduction and

productivity

initiative

($14,444)

(1.4%)

-

-

14,444

1.4%

-

-

14,444

$0.49

Q3 | 2023 | 20

Q3 | 2023 | 20

THIRD QUARTER 2022 GAAP TO NON-GAAP RECONCILIATION

The above adjusted selling and administrative expenses, adjusted selling and administrative expense rate, adjusted operating loss, adjusted operating loss rate, adjusted income tax benefit,

adjusted effective income tax rate, adjusted net loss, and adjusted diluted earnings (loss) per share are “non-GAAP financial measures” as that term is defined by Rule 101 of Regulation G (17

CFR Part 244) and Item 10 of Regulation S-K (17 CFR Part 229). These non-GAAP financial measures exclude from the most directly comparable financial measures calculated and presented in

accordance with GAAP store asset impairment charges of $21,723 ($16,348, net of tax).

Our management believes that the disclosure of these non-GAAP financial measures provides useful information to investors because the non-GAAP financial measures present an alternative

and more relevant method for measuring our operating performance, excluding special items included in the most directly comparable GAAP financial measures, that management believes is

more indicative of our on-going operating results and financial conditions. Our management uses these non-GAAP financial measures, along with the most directly comparable GAAP financial

measures, in evaluating our operating performance.

($ in thousands, except for earnings per share)

As reported

As adjusted

(non-GAAP)

Selling and administrative expenses

Selling and administrative expense rate

Operating loss

Operating loss rate

Income tax benefit

Effective income tax rate

Net loss

Diluted (loss) earnings per share

$503,016

41.8%

(130,811)

(10.9%)

(33,992)

24.8%

(103,013)

($3.56)

($21,723)

(1.8%)

21,723

1.8%

5,375

0.0%

16,348

$0.56

$481,293

40.0%

(109,088)

(9.1%)

(28,617)

24.8%

(86,665)

($2.99)

Adjustment to

exclude store

asset impairment

charges

APPENDIX

Q3 | 2023 | 21

Q3 | 2023 | 21

YTD 2023 GAAP TO NON-GAAP RECONCILIATION

The above adjusted selling and administrative expenses, adjusted selling and administrative expense rate, adjusted depreciation expense, adjusted depreciation expense rate, adjusted gain on sale of real estate, adjusted gain on sale of real

estate rate, adjusted operating loss, adjusted operating loss rate, adjusted income tax expense (benefit), adjusted effective income tax rate, adjusted net loss, and adjusted diluted earnings (loss) per share are “non-GAAP financial measures” as

that term is defined by Rule 101 of Regulation G (17 CFR Part 244) and Item 10 of Regulation S-K (17 CFR Part 229). These non-GAAP financial measures exclude from the most directly comparable financial measures calculated and presented

in accordance with GAAP synthetic lease exit costs and related expenses of $53,610 ($39,780, net of tax), FDC contract termination costs and related expenses of $21,399 ($16,589, net of tax), store asset impairment charges net of liability

extinguishment for terminated leases of previously impaired stores of $136,871 ($116,661, net of tax), a gain on sale of real estate and related expenses of $211,912 ($209,330, net of tax), fees related to a cost reduction and productivity

initiative which we refer to as “Project Springboard” of $19,864 ($18,592, net of tax), and an initial valuation allowance on deferred tax assets of $147,850 recorded in second quarter of 2023.

Our management believes that the disclosure of these non-GAAP financial measures provides useful information to investors because the non-GAAP financial measures present an alternative and more relevant method for measuring our

operating performance, excluding special items included in the most directly comparable GAAP financial measures, that management believes is more indicative of our on-going operating results and financial condition. Our management uses

these non-GAAP financial measures, along with the most directly comparable GAAP financial measures, in evaluating our operating performance.

($ in thousands, except for earnings per share)

As reported

As adjusted

(non-GAAP)

Selling and administrative expenses

Selling and administrative expense rate

Depreciation expense

Depreciation expense rate

Gain on sale of real estate

Gain on sale of real estate rate

Operating loss

Operating loss rate

Income tax expense (benefit)

Effective income tax rate

Net loss

Diluted (loss) earnings per share

$1,606,678

48.8%

110,986

3.4%

(211,912)

(6.4%)

(363,584)

(11.1%)

53,672

(13.5%)

(451,167)

($15.49)

($136,871)

(4.2%)

-

-

-

-

136,871

4.2%

20,210

(5.3%)

116,661

$4.00

$1,382,964

42.0%

102,956

3.1%

-

-

(343,752)

(10.4%)

(56,638)

15.0%

(321,025)

($11.02)

Adjustment to

exclude store

asset

impairment

charges

APPENDIX

Adjustment to

exclude gain

on sale of real

estate and

related

expenses

-

-

-

-

211,912

6.4%

(211,912)

(6.4%)

(2,582)

0.7%

(209,330)

($7.19)

($53,610)

(1.6%)

-

-

-

-

53,610

1.6%

13,830

(3.6%)

39,780

$1.37

Adjustment to

exclude

synthetic lease

exit costs and

related

expenses

($13,369)

(0.4%)

(8,030)

(0.2%)

-

-

21,399

0.7%

4,810

(1.2%)

16,589

$0.57

Adjustment to

exclude forward

distribution center

contract termination

costs and related

expenses

Adjustment to

exclude fees

related to a cost

reduction and

productivity

initiative

Adjustment to

exclude

valuation

allowance on

deferred tax

assets

($19,864)

(0.6%)

-

-

-

-

19,864

0.6%

1,272

(0.3%)

18,592

$0.64

-

-

-

-

-

-

-

-

(147,850)

38.2%

147,850

$5.08

Q3 | 2023 | 22

Q3 | 2023 | 22

YTD 2022 GAAP TO NON-GAAP RECONCILIATION

The above adjusted selling and administrative expenses, adjusted selling and administrative expense rate, adjusted operating loss, adjusted operating loss rate, adjusted income tax benefit,

adjusted effective income tax rate, adjusted net loss, and adjusted diluted earnings (loss) per share are “non-GAAP financial measures” as that term is defined by Rule 101 of Regulation G (17

CFR Part 244) and Item 10 of Regulation S-K (17 CFR Part 229). These non-GAAP financial measures exclude from the most directly comparable financial measures calculated and presented in

accordance with GAAP store asset impairment charges of $48,828 ($34,497, net of tax).

Our management believes that the disclosure of these non-GAAP financial measures provides useful information to investors because the non-GAAP financial measures present an alternative

and more relevant method for measuring our operating performance, excluding special items included in the most directly comparable GAAP financial measures, that management believes is

more indicative of our on-going operating results and financial condition. Our management uses these non-GAAP financial measures, along with the most directly comparable GAAP financial

measures, in evaluating our operating performance.

($ in thousands, except for earnings per share)

As reported

As adjusted

(non-GAAP)

Selling and administrative expenses

Selling and administrative expense rate

Operating loss

Operating loss rate

Income tax benefit

Effective income tax rate

Net loss

Diluted earnings (loss) per share

$1,495,848

38.1%

(253,445)

(6.5%)

(66,751)

25.2%

(198,245)

($6.88)

($45,828)

(1.2%)

45,828

1.2%

11,331

0.1%

34,497

$1.20

$1,450,020

36.9%

(207,617)

(5.3%)

(55,420)

25.3%

(163,748)

($5.68)

Adjustment to

exclude store

asset impairment

charges

APPENDIX